I live in the USA and I am concerned about the future. I created this blog to share my thoughts on the economy and anything else that might catch my attention.

Wednesday, March 31, 2021

VPU Performance v.003

Months Elapsed: 3

Total Growth: 5.23%

Annualized Growth Rate: 22.60%

Distribution Yield (TTM): 3.17%

VPU paid a $0.9851 dividend today (a 9.5% increase from 2020 Q1). It was automatically reinvested through a DRIP @ $139.874. VPU closed @ $140.51.

From down 4.59% last month to up 5.23% now, it's been quite a volatile start. Live by the sword, die by the sword, live, die, and so on.

3 months down, 197 to go.

Saturday, March 27, 2021

New York City Restaurant Employment

The exponential growth trend failed in 2015, the Fed started raising rates in 2016, and then the pandemic hit in 2020. What's next? Meteor?

Source Data:

St. Louis Fed: All Employees: Leisure and Hospitality: Full-Service Restaurants in New York City, NY

Thursday, March 25, 2021

Revisiting a 2014 Fed Funds Rate Prediction for 2020

September 25, 2014

Illusion of Prosperity: Fed Funds Rate Prediction for 2020 (Musical Tribute)

I'd be tempted to predict a rate between 1.0% and 3.3% based on the "Cone of Decaying Monetary Policy" channel (and using the inverses of the natural logs to predict the rate in the future). However, that would assume we can even get back into that channel and stay there for any appreciable length of time. Can you say exponential trend channel failure?

I therefore predict that the Fed Funds Rate at some point in 2020 will be a mere 0.25%. Think ZIRP + Japan. It just feels right (and oh so wrong). Can it go higher between now and then? Maybe, maybe not. The higher it goes the more likely a monster will be unleashed though. I have few doubts about that.

Dare I double down with the exact same rate prediction for 2030? I do dare! 0.25% at most.

When milk sours over time, more time just means more sour. At no point does the milk start becoming fresh again. Interest rates have been exponentially decaying for 40 years. Old money won’t soon be turning fresh again.

I might sound like a broken record, but this economy can’t afford to reward savers with vast riches any longer. If you are a saver, don’t panic though. This economy also can’t afford stagflation or hyperinflation. The only temporary safe harbor is to keep following Japan’s lead. Won’t work forever, but it may delay the inevitable for far longer than most think possible, in theory.

My opinion and a dollar could pay off the total credit market debt outstanding, if repeated 83,523,750,000,000 times. Unfortunately, I'll run out of dollars long before I run out of opinions!

Illusion of Prosperity: Fed Funds Rate Prediction for 2020 (Musical Tribute)

I'd be tempted to predict a rate between 1.0% and 3.3% based on the "Cone of Decaying Monetary Policy" channel (and using the inverses of the natural logs to predict the rate in the future). However, that would assume we can even get back into that channel and stay there for any appreciable length of time. Can you say exponential trend channel failure?

I therefore predict that the Fed Funds Rate at some point in 2020 will be a mere 0.25%. Think ZIRP + Japan. It just feels right (and oh so wrong). Can it go higher between now and then? Maybe, maybe not. The higher it goes the more likely a monster will be unleashed though. I have few doubts about that.

Dare I double down with the exact same rate prediction for 2030? I do dare! 0.25% at most.

When milk sours over time, more time just means more sour. At no point does the milk start becoming fresh again. Interest rates have been exponentially decaying for 40 years. Old money won’t soon be turning fresh again.

I might sound like a broken record, but this economy can’t afford to reward savers with vast riches any longer. If you are a saver, don’t panic though. This economy also can’t afford stagflation or hyperinflation. The only temporary safe harbor is to keep following Japan’s lead. Won’t work forever, but it may delay the inevitable for far longer than most think possible, in theory.

My opinion and a dollar could pay off the total credit market debt outstanding, if repeated 83,523,750,000,000 times. Unfortunately, I'll run out of dollars long before I run out of opinions!

Wednesday, March 24, 2021

Guard Cat on Duty

Don’t be deceived by the placement of the vent. I assure you that Dexter is guarding the front door. The warm air flow is just a coincidence. 🤪

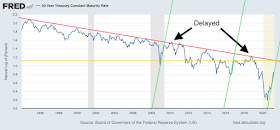

Revised Estimate for the Upcoming 30-Year Treasury Yield Peak: 2.8% to 3.1%

Steep climbs tend to fizzle out at the end, as the momentum fades. This estimate range of 2.8% to 3.1% assumes a 1 to 2 year delay. For a description and reasoning behind my first estimate of 3.2%, see here.

I see no reason to panic. There is no drama here, at least not yet. The drama would start, for me, if we breach the red line by a sizable margin. Until that point, I continue to strongly believe that the long-term trend in the 30-year Treasury yield will continue to exponentially decay. And not in spite of the M2 money stock growing exponentially, but at least partially because of it.

The king of bonds may thought to be dead, but long live the king!

Wednesday, March 17, 2021

Guard Dog Training

River barks nonstop when trucks deliver packages to our home (or a neighbor's home), but patiently watches when trucks remove packages from our home (or a neighbor's home).

I don't mean to brag, but I think we've done an exceptional job with her training. Perhaps I should write a book? Hahaha! :)

Timing the Corporate Bond Bubble Collapse

The following chart shows nonfinancial corporate debt securities and loans divided by M2 money stock.

For those who are predicting that the corporate bond bubble will soon pop, I offer my congratulations. Relative to the money supply, you've already won! Come collect your trophy!

The distant future

The year 2000

The distant future, the year 2000

The distant future, the distant future

For those who are predicting that the corporate bond bubble will soon pop, I offer my congratulations. Relative to the money supply, you've already won! Come collect your trophy!

The distant future

The year 2000

The distant future, the year 2000

The distant future, the distant future

Tuesday, March 16, 2021

Where Will You Be Six Years Later?

Forbes: Interest Rates To Scream Higher When Fed Stops The Music

The music has been playing and fixed-income investors have been enthusiastically dancing since 2008. During the past six years the Federal Reserve’s dovish stance has pushed interest rates to all-time lows...

It's true. I can't argue with that. The past six years have been especially brutal for short-term savers. Perhaps things truly will change when the Fed stops the music.

Torsten Slok, PH.D and Chief International Economist at Deutsche Bank Securities believes fixed income investors might be partying today but their hangover will be both abrupt and long term. This hangover will not be the typical frontal lobe variety but instead will be painful for the entire fixed income market. He believes, “the violence of the Fed turning hawkish will depend on positioning at the time and how long it will take fixed income investors to recognize that this will be a regime change away from the carry trade that has worked so well for the past 5 years”.

Scary stuff, to be sure. Combined with a screaming headline, that clever description of a hangover not of the typical frontal lobe variety is enough to send chills down a person’s spine, I must admit.

Where will you be six years later? Some might argue that there's no way to know. Some will argue that rates can only go up. I am not such a person, for I know something with 100% certainty that Torsten Slok, PH.D did not know as he wrote this. The 10-year Treasury yield will fall 1.90%. I know you are skeptical. How can I possibly know with such certainty and precision? It’s easy, actually.

This article was published on June 24, 2014! The 10-year Treasury yielded 2.59% on that day.

Exactly six years later, I was confined to my home during a pandemic, sitting in cash, wondering how and when to redploy recent Treasury bond profits, and staring at an unacceptably low 10-year Treasury yield of just 0.69%! That's where I frickin' was!

You really should have seen it coming. Some of you probably did. If I was willing to tease our beloved German Shepherd in the last post, then I'm certainly willing to tease Torsten Slok, PH.D.

It's tough to make predictions, especially about the future. - Yogi Berra

The music has been playing and fixed-income investors have been enthusiastically dancing since 2008. During the past six years the Federal Reserve’s dovish stance has pushed interest rates to all-time lows...

It's true. I can't argue with that. The past six years have been especially brutal for short-term savers. Perhaps things truly will change when the Fed stops the music.

Torsten Slok, PH.D and Chief International Economist at Deutsche Bank Securities believes fixed income investors might be partying today but their hangover will be both abrupt and long term. This hangover will not be the typical frontal lobe variety but instead will be painful for the entire fixed income market. He believes, “the violence of the Fed turning hawkish will depend on positioning at the time and how long it will take fixed income investors to recognize that this will be a regime change away from the carry trade that has worked so well for the past 5 years”.

Scary stuff, to be sure. Combined with a screaming headline, that clever description of a hangover not of the typical frontal lobe variety is enough to send chills down a person’s spine, I must admit.

Where will you be six years later? Some might argue that there's no way to know. Some will argue that rates can only go up. I am not such a person, for I know something with 100% certainty that Torsten Slok, PH.D did not know as he wrote this. The 10-year Treasury yield will fall 1.90%. I know you are skeptical. How can I possibly know with such certainty and precision? It’s easy, actually.

This article was published on June 24, 2014! The 10-year Treasury yielded 2.59% on that day.

Exactly six years later, I was confined to my home during a pandemic, sitting in cash, wondering how and when to redploy recent Treasury bond profits, and staring at an unacceptably low 10-year Treasury yield of just 0.69%! That's where I frickin' was!

You really should have seen it coming. Some of you probably did. If I was willing to tease our beloved German Shepherd in the last post, then I'm certainly willing to tease Torsten Slok, PH.D.

As for any others teased along the way, sorry about the collateral damage! :)

It's tough to make predictions, especially about the future. - Yogi Berra

Monday, March 15, 2021

We’ve Got a Package!

River takes package deliveries very seriously. Due to the pandemic, she's had a lot of practice.

I don't normally tease her like this. Also know that she always gets a treat each time there is a delivery. :)

Saturday, March 13, 2021

The Fed’s Been Buying Extra TIPS

March 3, 2021

Forbes: A TIP To The Wise: Don’t Look At TIPS To Protect Against Inflation From Here

Alas, I believe the metric is no longer valid as an informational tool. This is because the Fed has bought more TIPS since the coronavirus crisis started last year than the total amount issued. Digest that for a moment: the Fed bought over $175 billion of TIPS from March 13, 2020 to the end of February, 2021, whereas only $150 billion or so of new TIPs were issued (Source: Bloomberg, Federal Reserve). In percentage terms, the holdings of the Fed have gone from less than 10% over the same period to over 20%. Of the over $1.5 Trillion dollars of outstanding TIPs, the Fed owns over $300 Billion. And yes, the Fed has also bought a very large amount of ordinary, nominal Treasuries.

The metric that seems to be no longer valid is using the difference in rates between nominal Treasuries and inflation-protected Treasuries to determine future inflation expectations.

In theory, by concentratong more on buying TIPS, the Fed is distorting the market's inflation information.

However, I feel like there's a piece of this puzzle that's possibly still missing. If the market itself was buying extra TIPS, it seems possible to ne that the Fed was simply following the market's lead. In that case, the Fed would be buying more in an attempt to not distort the market's inflation information.

In any event, it is certainly very interesting to me that the Fed's been buying more TIPS than have actually been issued lately.

Long-term readers of this blog know that TIPS are a favorite investment of mine, since I value capital preservation and sleep over the potential rewards of growth. I recently sold some TIPS to buy utility stocks. Should the real yield on the 30-year TIPS reach 1% again someday, I'd be very tempted to embrace TIPS fully again. Since I also believe that yields will continue to fall over the long-term, the temporary window of that opportunity happening may be closing. That's especially true if the Fed keeps buying like they have been.

In my very humble opinion, the most likely opportunity will be within a year. Nothing drives real yields higher like "economy overheating" in the headlines. And right now, momentum is driving yields higher. Where it stops nobody knows. It seems extremely unlikely to me that we'll be seeing overheating economy headlines several years from now though, even if we are still stuck in ZIRP. Or perhaps I should say, especially if we are still stuck in ZIRP.

Forbes: A TIP To The Wise: Don’t Look At TIPS To Protect Against Inflation From Here

Alas, I believe the metric is no longer valid as an informational tool. This is because the Fed has bought more TIPS since the coronavirus crisis started last year than the total amount issued. Digest that for a moment: the Fed bought over $175 billion of TIPS from March 13, 2020 to the end of February, 2021, whereas only $150 billion or so of new TIPs were issued (Source: Bloomberg, Federal Reserve). In percentage terms, the holdings of the Fed have gone from less than 10% over the same period to over 20%. Of the over $1.5 Trillion dollars of outstanding TIPs, the Fed owns over $300 Billion. And yes, the Fed has also bought a very large amount of ordinary, nominal Treasuries.

The metric that seems to be no longer valid is using the difference in rates between nominal Treasuries and inflation-protected Treasuries to determine future inflation expectations.

In theory, by concentratong more on buying TIPS, the Fed is distorting the market's inflation information.

However, I feel like there's a piece of this puzzle that's possibly still missing. If the market itself was buying extra TIPS, it seems possible to ne that the Fed was simply following the market's lead. In that case, the Fed would be buying more in an attempt to not distort the market's inflation information.

In any event, it is certainly very interesting to me that the Fed's been buying more TIPS than have actually been issued lately.

Long-term readers of this blog know that TIPS are a favorite investment of mine, since I value capital preservation and sleep over the potential rewards of growth. I recently sold some TIPS to buy utility stocks. Should the real yield on the 30-year TIPS reach 1% again someday, I'd be very tempted to embrace TIPS fully again. Since I also believe that yields will continue to fall over the long-term, the temporary window of that opportunity happening may be closing. That's especially true if the Fed keeps buying like they have been.

In my very humble opinion, the most likely opportunity will be within a year. Nothing drives real yields higher like "economy overheating" in the headlines. And right now, momentum is driving yields higher. Where it stops nobody knows. It seems extremely unlikely to me that we'll be seeing overheating economy headlines several years from now though, even if we are still stuck in ZIRP. Or perhaps I should say, especially if we are still stuck in ZIRP.

Thursday, March 11, 2021

Derailed

There was an uptick in passenger train travel after the Great Recession. Unfortunately, it was not a permanently high plateau.

It will be interesting to see what what happens after the Covid-19 recession.

Is a train trip a way to enjoy the newfound freedoms offered by the end of a pandemic? Or will it feel more like being stuck in a home with wheels on it? Is train cabin fever a thing?

The Sarcasm Report v.284

March 10, 2021

Bloomberg: A New ETF Named FOMO Targets Everything From SPACs to Volatility

If it comes to market, FOMO will be the latest in a series of ETFs appealing to the runaway risk appetite sweeping across assets.

Don't forget to buy FOMO on margin. Wouldn't want to risk missing out on the extra returns that leverage can provide when buying an ETF based on the fear of missing out.

Bloomberg: A New ETF Named FOMO Targets Everything From SPACs to Volatility

If it comes to market, FOMO will be the latest in a series of ETFs appealing to the runaway risk appetite sweeping across assets.

Don't forget to buy FOMO on margin. Wouldn't want to risk missing out on the extra returns that leverage can provide when buying an ETF based on the fear of missing out.

Wednesday, March 10, 2021

M2 and Interest Rates

The following chart shows how much interest would be generated if the M2 money supply earned the same interest as the 10-year Treasury bond.

The M2 money supply is growing exponentially. The 10-year Treasury yield has been decaying exponentially. Ignoring volatility, the end result has pretty much been a constant for 40 years. Behold the power of falling off the gold standard.

Although correlation doesn't imply causation, I don't believe this is a coincidence. Deep down, I think we all know what would happen to our economy if interest rates rose to 10%. Saying that it would not be pretty would be an understatement.

Those expecting interest rates to increase because the money supply has suddenly increased may be very disappointed. To support my belief, why would banks raise interest rates to attract more deposits when they are already flooded with deposits?

As a side note, should we be worried that the chart has become more volatile over the past 20 years?

Nothing lasts forever.

The M2 money supply is growing exponentially. The 10-year Treasury yield has been decaying exponentially. Ignoring volatility, the end result has pretty much been a constant for 40 years. Behold the power of falling off the gold standard.

Although correlation doesn't imply causation, I don't believe this is a coincidence. Deep down, I think we all know what would happen to our economy if interest rates rose to 10%. Saying that it would not be pretty would be an understatement.

Those expecting interest rates to increase because the money supply has suddenly increased may be very disappointed. To support my belief, why would banks raise interest rates to attract more deposits when they are already flooded with deposits?

As a side note, should we be worried that the chart has become more volatile over the past 20 years?

Nothing lasts forever.

Thoughts on CPI and Food

Yawn. What about food?

Yawn. What about producer prices for food?

Yawn.

Can't promise that I won't be screaming in abject terror at some point in the future though, especially if I am wrong about the future of ZIRP, inflation, and/or long-term interest rates.

Tuesday, March 9, 2021

The Road to NIRP Is Paved with ZIRP Intentions

The following table shows the annualized inflation rate in the 2 years before each recent recession, the inflation rate in the 2 years after each recent recession, and the differences between them.

I am not a believer in the economy will soon overheat theory. A $1.9 trillion stimulus package might sound like a shockingly large sum of money, but let's put this in perspective. Household net worth now stands at $123 trillion and has grown $63 trillion since the Great Recession in 2009. By comparison, $1.9 trillion is like loose change found in the couch.

Our exponentially growing monetary addiction requires ever increasing sums just so the wheels don't fall off. Has anyone actually considered that $1.9 trillion might not be enough?

Ten Rhetorical Stimulus Questions

1. Are we supposed to be shock and awed by a $1.9 trillion stimulus package that's only equivalent to 1.5% of household net worth?

2. What if savers continue to save?

3. Are we counting on savers to spend?

4. Are we counting on spenders to spend what they've already spent?

5. How does one hoard services?

6. If there really is pent-up demand for haircuts, will people be getting twice as many over the next 2 years?

7. How much of a $1400 stimulus check would we need to save to earn $4.20 in annual interest in an online savings account that only has a 0.3% interest rate?

8. Should we use the $1400 instead to buy 100+ fast food meals, 2 shares of Tesla @ $674, or 5 shares of GameStop @ $247?

9. Easy come, easy go. Am I right?

10. Human sacrifice? Dogs and cats living together? Mass hysteria?

Humans needlessly sacrificed, dogs and cats living together, mass hysteria. It's been quite a year.

I am not a believer in the economy will soon overheat theory. A $1.9 trillion stimulus package might sound like a shockingly large sum of money, but let's put this in perspective. Household net worth now stands at $123 trillion and has grown $63 trillion since the Great Recession in 2009. By comparison, $1.9 trillion is like loose change found in the couch.

Our exponentially growing monetary addiction requires ever increasing sums just so the wheels don't fall off. Has anyone actually considered that $1.9 trillion might not be enough?

Ten Rhetorical Stimulus Questions

1. Are we supposed to be shock and awed by a $1.9 trillion stimulus package that's only equivalent to 1.5% of household net worth?

2. What if savers continue to save?

3. Are we counting on savers to spend?

4. Are we counting on spenders to spend what they've already spent?

5. How does one hoard services?

6. If there really is pent-up demand for haircuts, will people be getting twice as many over the next 2 years?

7. How much of a $1400 stimulus check would we need to save to earn $4.20 in annual interest in an online savings account that only has a 0.3% interest rate?

8. Should we use the $1400 instead to buy 100+ fast food meals, 2 shares of Tesla @ $674, or 5 shares of GameStop @ $247?

9. Easy come, easy go. Am I right?

10. Human sacrifice? Dogs and cats living together? Mass hysteria?

Humans needlessly sacrificed, dogs and cats living together, mass hysteria. It's been quite a year.

Monday, March 8, 2021

Mount Deadcatbouncus

The following chart shows the national average of 5-year CD rates on amounts less than $100,000.

As seen in the chart, Mount Deadcatbouncus erupted in the spring of 2019, long before Covid-19 was even a thing.

Thanks to the "rising" interest rate environment we now find ourselves in, savers nationwide are pinning their hopes and dreams on a new and more prosperous Mount Fatchancus forming. May they find much better luck than their predecessors.

As seen in the chart, Mount Deadcatbouncus erupted in the spring of 2019, long before Covid-19 was even a thing.

Thanks to the "rising" interest rate environment we now find ourselves in, savers nationwide are pinning their hopes and dreams on a new and more prosperous Mount Fatchancus forming. May they find much better luck than their predecessors.

Friday, March 5, 2021

Thursday, March 4, 2021

The Sarcasm Report v.283

March 4, 2021

CNBC: Cramer says investors are in denial about stocks: ‘The sell-off is real’

“Right now, even after a 6% decline, we’ve still got a ton of denial,” Cramer said. “People don’t want to believe the sell-off is real. The market’s been so good for so long, and many newer investors have never seen this kind of pummeling, so the downdraft does seem pretty surreal.”

I know that many newer investors probably don't want to read up on ancient history, but the 2020 stock market crash also seemed pretty surreal.

CNBC: Cramer says investors are in denial about stocks: ‘The sell-off is real’

“Right now, even after a 6% decline, we’ve still got a ton of denial,” Cramer said. “People don’t want to believe the sell-off is real. The market’s been so good for so long, and many newer investors have never seen this kind of pummeling, so the downdraft does seem pretty surreal.”

I know that many newer investors probably don't want to read up on ancient history, but the 2020 stock market crash also seemed pretty surreal.