I live in the USA and I am concerned about the future. I created this blog to share my thoughts on the economy and anything else that might catch my attention.

Friday, January 28, 2022

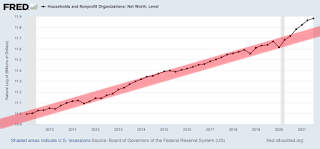

Household Net Worth

Behold the household wealth creation of a pandemic combined with ZIRP. Broken window fallacies be damned. Break them, and break them good I say. It's a brand new era of unprecedented prosperity! And should this plan ever start to falter, look for plague, pestilence, and NIRP to save the day!!

Seriously. Other than recent bitcoin and stock market performance, there's absolutely no reason to fear downside risk or reversion towards the mean theories. Even in uncharted territory, the Fed always knows what it's doing. Always has your back!

I know I said I was serious in the last paragraph. It was gallows humor. Sorry about that. I actually just bought more I-Bonds. Not only do they track inflation as seen in the CPI, but they can never deflate. Not that many are all that worried about deflation again. Yet.

Nominal, or inflation adjusted wealth? And what's the socioeconomic distribution of the gains?

ReplyDeleteThe pandemic was very good for the laptop class. Not so much for anyone else.

1. Nominal.

ReplyDelete2. Abnormal distribution (not a bell curve).

https://www.cnbc.com/amp/2021/08/03/most-of-americas-extra-pandemic-savings-are-going-to-the-wealthy-.html

Economists say high-end restaurants, resorts, fashion, collectibles, jewelry, wine and other businesses that cater to the affluent will do better in the coming months than retailers and businesses for the mass market.

Let them eat cake and caviar.

So in other words, we need to deflate that by the change in price of tomato soup.

ReplyDeleteNow, your chart shows nominal net worth up 9% over a decade. The tomato soup chart shows that buys approximately 30% less soup.

Definitely seeing significant price increases in canned goods at my end, just since the start of the pandemic.

ReplyDeleteI should have mentioned that the chart shows the natural log of net worth, so that constant exponential growth is seen as a straight line (which is seen in the very straight trend channel in red). Therefore, total net worth is up much, much more than soup prices over the last decade. Not much consolation to those living paycheck to paycheck who rely on cheap canned goods though.

Here’s the chart in its original form:

https://fred.stlouisfed.org/graph/fredgraph.png?g=LJQz

I feel the need to add that temporary short-term stimulus checks can buy a lot of temporary canned goods. What a bargain! Well, until you realize that canned goods may now cost more over the long-term and the stimulus checks won’t continue forever. At least not yet.

ReplyDeleteIt’s more anecdotal evidence that there really are no free lunches. Somebody ultimately needs to pay. And that someone, is us.

https://despair.com/products/government?variant=2457297091

So XBI has started to climb back out of the cellar…

ReplyDeleteI had picked $70 in the “falling-knife pool”, but that just means that I’m not correct “yet.”

Then again, maybe $70 was a bridge too far?

I’m focused on the 30-year TIPS yield which is now positive again. Barely (0.02%). The higher it goes, the more tempting it gets. I’d love to lock in a real yield long-term again. Not tempting enough, yet. Maybe 0.5% is also a bridge too far?

ReplyDeleteThe chart frightens me to the core, in an illusion of prosperity sort of way.

ReplyDeleteYou can discover what your enemy fears most by observing the means he uses to frighten you. - Eric Hoffer

I have only myself to blame. Plenty of scary charts on this blog, lol. Sigh. ;)

The good news is if we get a stock market crash NIIP's gotta go back up??

ReplyDeleteHey Mark!!!!

ReplyDeleteI was once GYSC and ran EconomicDisconnet (still on our blog list!) back in the day. I walked away from writing and things economic a while ago. It's been great. Built out my scientist career (molecular biology, enzymology, virology, natural product gene pathways), fished all over this hemisphere, became a collector of Japanese nihonto. All good.

Until a little over 2 years ago. Seems the same sort of "experts" that broke the debt markets and housing/banks back in the day were the same quality as those that run the CDC, NIH and public health. So they destroyed science as real scientists know it. Oh well, they can never leave me alone!

Hope all is well.

J

economic,

ReplyDeleteHe lives!! Glad to hear things are going well, well, almost well. *cringe*

If things continue to go south you could always become a game programmer. Hardly any bureaucracy! Barely any fraud! I’m sure my experiences were the exception and not the rule. In fact, I’m almost as sure of that as I am that the Fed can engineer a perfect soft landing!

Nothing but real prosperity from here on out, no doubt. ;)

P.S. Got toilet paper for what’s coming someday? Again? Never hurts to have extra, as I’ve said so many times on this blog, lol. Seriously. Sigh.