Dear Customer,

This is a system generated email to communicate we received your Savings Bonds/Treasury Marketable Securities materials.

Cases are worked in the order they are received in our office. Your request is important to us and will receive attention as soon as possible. Please allow up to 13 weeks for review and processing. If we require additional information, we will contact you. Thank you for your patience.

Up to 13 weeks? Ouch. The wheels on the governmental bureaucratic bus go round and round, round and round, round and round.

I live in the USA and I am concerned about the future. I created this blog to share my thoughts on the economy and anything else that might catch my attention.

Tuesday, December 13, 2022

Tuesday, November 22, 2022

Elondriel’s Next Motivational Speech

In place of Twitter you would have a King! Not dark but beautiful and terrible as the seven cent Doge! Treacherous as the SpaceX! Stronger than the foundations of Tesla! All shall love me and despair!

Thursday, November 17, 2022

Cancel Cultured Redux

November 17, 2022

The Guardian: Twitter user gets account back after ban for ‘intimate’ image of meteor

“It was not offensive or pornographic at all,” said McIntyre. “It was just a meteor.”

Been there, done that. It was just a puppy! It was just a circle! Ignorance of the social media law is no defense.

The social media law could not be any more clear. Do not post content that could potentially offend any human, either real or imagined.

Here is a concrete example of what not to post:

Very offensive. Don't do that. ;)

The Guardian: Twitter user gets account back after ban for ‘intimate’ image of meteor

“It was not offensive or pornographic at all,” said McIntyre. “It was just a meteor.”

Been there, done that. It was just a puppy! It was just a circle! Ignorance of the social media law is no defense.

The social media law could not be any more clear. Do not post content that could potentially offend any human, either real or imagined.

Here is a concrete example of what not to post:

Very offensive. Don't do that. ;)

Monday, November 14, 2022

Cancel Cultured

I bought a pretty fantastic magnetic tool on Amazon for drawing circles. Amazon pestered me to leave reviews, so I opted to comply. After submitting the following one sentence glowing review with this video demonstrating the product in all of its glory, Amazon deleted all of my reviews and has warned me to follow their guidelines. By the way, ignoring these guidelines can apparently lead to my account being suspended. Since I own Kindle books and am not much of a risk taker, no more Amazon reviews from me. Ever.

Welcome to social media dystopian crazy metropolis, which is a few steps up from crazy town. We've come a long way since the days I deleted my Twitter account for being shadow banned due to posting puppy pictures. A long, long way. You don't even need to incite an insurrection. Progress!

We are so headed down the doom scrolling dystopian path, and with it the illusion of prosperity will surely prosper. The illusion that is, not so much the prosperity. Sigh.

Welcome to social media dystopian crazy metropolis, which is a few steps up from crazy town. We've come a long way since the days I deleted my Twitter account for being shadow banned due to posting puppy pictures. A long, long way. You don't even need to incite an insurrection. Progress!

We are so headed down the doom scrolling dystopian path, and with it the illusion of prosperity will surely prosper. The illusion that is, not so much the prosperity. Sigh.

Thursday, November 10, 2022

Gimme Shelter

The following chart shows the natural log of the CPI for shelter. When using natural logs, constant exponential growth is seen as a straight line. I have added long-term trend lines in red.

With lofty housing prices and lofty mortgage rates, it seems very unlikely that we're going to make it back to the top of the trend channel anytime soon. Which, if you think about it, is kind of odd. I could swear that the Fed really wanted that. Just not all at once, apparently. Too bad.

If I were a gambling man, I would wager that there is more risk leaving the channel to the downside than to the upside. And maybe I am a gambling man, because I continue to hold TLT. Very encouraged by today's CPI report. One battle doesn't win the war though, of course.

With lofty housing prices and lofty mortgage rates, it seems very unlikely that we're going to make it back to the top of the trend channel anytime soon. Which, if you think about it, is kind of odd. I could swear that the Fed really wanted that. Just not all at once, apparently. Too bad.

If I were a gambling man, I would wager that there is more risk leaving the channel to the downside than to the upside. And maybe I am a gambling man, because I continue to hold TLT. Very encouraged by today's CPI report. One battle doesn't win the war though, of course.

Sunday, October 30, 2022

Been There, Done That

The following chart shows the natural log of total business inventories. When using natural logs, constant exponential growth is seen as a straight line. I have added a long-term trend channel in red.

Saturday, October 29, 2022

Massive Economic Uncertainty Continues

So many consumer surveys, but none of them ask the key questions for the next year:

- How much did you accumulate in savings during the pandemic?

- How much do you have left?

- How much of that do you intend to spend?

Without the answers, forecast margins of error are *massive.*

Twitter: Ian Shepherdson

Great questions. Too bad the Fed Chairman can't see the answers.

- How much did you accumulate in savings during the pandemic?

- How much do you have left?

- How much of that do you intend to spend?

Without the answers, forecast margins of error are *massive.*

Twitter: Ian Shepherdson

Great questions. Too bad the Fed Chairman can't see the answers.

Monday, October 24, 2022

Jerome “The Earl” Powell

The following chart shows the unemployment rate minus the 12-month percentage change in the median CPI. I have added long-term trend lines in red and a short-term arrow in green.

I looked at Earl and his eyes was wide

His lip was curled, and his leg was fried

And his hand was froze to the wheel

Like a tongue to a sled in the middle of a blizzard

I says, Earl, "I'm not the type to complain

But the time has come for me to explain

That if you don't apply some brake real soon

They're gonna have to pick us up with a stick and a spoon"

I looked at Earl and his eyes was wide

His lip was curled, and his leg was fried

And his hand was froze to the wheel

Like a tongue to a sled in the middle of a blizzard

I says, Earl, "I'm not the type to complain

But the time has come for me to explain

That if you don't apply some brake real soon

They're gonna have to pick us up with a stick and a spoon"

Saturday, October 22, 2022

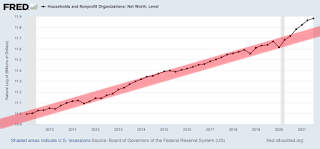

Net Worth to Total Debt Ratio

The following chart shows household and nonprofit organization net worth divided by total debt in all sectors.

As seen using the red channel, this 60-year linear trend has failed by a large amount in the aftermath of the Great Recession. Epic failure, actually. Should have more of them. Never before has so much additional prosperity been generated by so little additional debt.

Of course, not everyone believes that fairy tales always have happy endings. Here's a scary fable involving bears that's just in time for Halloween.

Net worth has been falling rapidly lately, thanks to the stock and bond markets. We'd be back in the channel if it were to fall another 30% or so, assuming it were to continue to happen rather quickly. And what would be quicker than rapidly rising mortgage rates combined with million dollar homes?

Of course, there's another way to get back in the trend channel. Total credit market debt outstanding is only $91.2 trillion. Yes, only $91.2 trillion. A pittance, really. If we were to quickly increase it by 40% then back in the "safety" of the declining channel we would be. Think what we could do with all that free money! Here's an idea. A $36 trillion Halloween party in the name of world peace! Everyone on the planet could be invited. Nobody goes home empty handed. Woohoo!

Please don't confuse my love of gallows humor for sarcasm, nor my love of sarcasm for gallows humor. It's both. It's almost always both these days, lol. Sigh.

As seen using the red channel, this 60-year linear trend has failed by a large amount in the aftermath of the Great Recession. Epic failure, actually. Should have more of them. Never before has so much additional prosperity been generated by so little additional debt.

Of course, not everyone believes that fairy tales always have happy endings. Here's a scary fable involving bears that's just in time for Halloween.

Net worth has been falling rapidly lately, thanks to the stock and bond markets. We'd be back in the channel if it were to fall another 30% or so, assuming it were to continue to happen rather quickly. And what would be quicker than rapidly rising mortgage rates combined with million dollar homes?

Of course, there's another way to get back in the trend channel. Total credit market debt outstanding is only $91.2 trillion. Yes, only $91.2 trillion. A pittance, really. If we were to quickly increase it by 40% then back in the "safety" of the declining channel we would be. Think what we could do with all that free money! Here's an idea. A $36 trillion Halloween party in the name of world peace! Everyone on the planet could be invited. Nobody goes home empty handed. Woohoo!

Please don't confuse my love of gallows humor for sarcasm, nor my love of sarcasm for gallows humor. It's both. It's almost always both these days, lol. Sigh.

Sunday, October 16, 2022

Whip Inflation Now!

The following chart shows the natural log of the 30-year Treasury yield. When using natural logs, constant exponential growth (or decay) is seen as a straight line. I have added long-term trend lines in red and a short-term trend arrow in green.

Will the long-term trend ultimately prevail? Trapped in a world of nearly permanent ZIRP?

Will the short-term trend break everything? Housing! Stocks! Bonds! Employment!

Will it be a combination of both? Or neither?

Stay tuned for the next exciting and terrifying episode of...

Global Devolution!

Will the long-term trend ultimately prevail? Trapped in a world of nearly permanent ZIRP?

Will the short-term trend break everything? Housing! Stocks! Bonds! Employment!

Will it be a combination of both? Or neither?

Stay tuned for the next exciting and terrifying episode of...

Global Devolution!

Tuesday, October 4, 2022

This Is Why

Now you know.

But seriously, this song was just released and I love it! Thought I'd share. :)

Sunday, October 2, 2022

Soft Landing?

The following is a chart of QQQ using a log scale. I have added a long-term trend channel in red.

Chart courtesy of StockCharts.com.

THIS IS YOUR CAPTAIN!!

BRACE FOR EMERGENCY SOFT LANDING!!!

Chart courtesy of StockCharts.com.

THIS IS YOUR CAPTAIN!!

BRACE FOR EMERGENCY SOFT LANDING!!!

Friday, September 30, 2022

The Exponential Path to Dystopia

The following chart shows the natural log of the dividends to wages ratio. When using natural logs, constant exponential growth is seen as a straight line. I have added two trend lines in red (one for the peaks and one for the troughs).

The two trend lines can be traced back to where they meet. The year was roughly 1971. Doubt it's a coincidence. I'm tempted to say that falling off of the gold standard is when the illusion of long-term prosperity truly began. Kind of makes me feel like a prosperity chart archeologist.

As disturbing as that is, I'm not done yet. Note that:

1. Bad things often happen when we move towards the troughs.

2. We've been moving towards a trough lately.

3. Very bad things have been happening lately.

4. Should we ultimately reach the next trough, there's still a very long way to go.

The two trend lines can be traced back to where they meet. The year was roughly 1971. Doubt it's a coincidence. I'm tempted to say that falling off of the gold standard is when the illusion of long-term prosperity truly began. Kind of makes me feel like a prosperity chart archeologist.

As disturbing as that is, I'm not done yet. Note that:

1. Bad things often happen when we move towards the troughs.

2. We've been moving towards a trough lately.

3. Very bad things have been happening lately.

4. Should we ultimately reach the next trough, there's still a very long way to go.

Thursday, September 29, 2022

Risky Businesses

The following chart compares the investment performance of XLU (utilities ETF) to TLT (long-term treasury bond fund).

Chart courtesy of StockCharts.com.

The only thing I can say with 100% certainty is that I have absolutely no desire to sell TLT to buy XLU right now, and if I can't buy "safe" XLU then I definitely don't want to own any other stocks.

Not investment advice.

Chart courtesy of StockCharts.com.

The only thing I can say with 100% certainty is that I have absolutely no desire to sell TLT to buy XLU right now, and if I can't buy "safe" XLU then I definitely don't want to own any other stocks.

Not investment advice.

Trading Update

Sold the platinum eagles I bought at $1083.74 on 8/24/21 for $904.34 ($40 over spot) today. Fairly hefty loss, with nearly half of it coming from transaction fees (counting both the buying and the selling). In hindsight, not ideal. It was a very small position, but painful just the same.

I intended to hold for many years, but what a difference a year makes. When I bought, the 10-year TIPS yielded -1.01%. Today, it yields +1.39%. I must admit that I never saw that coming. It's a game changer, at least temporarily, if nothing else.

That's not the main reason why I sold though. I needed to sell something in order to pay ongoing expenses. My choices were TIPS outside my retirement account, I-Bonds, EE-Bonds, and these coins.

I don't want to sell anything that would push up my income this year, because I still qualify for the health insurance subsidy of the Affordable Care Act. I also don't want to sell things that are generating inflationary gains with inflation running so hot.

So, as much as it pains me, the coins had to go (and some I-Bonds too, soon). At least I can put the capital loss to very good taxation use thanks to my other investments tied directly to inflation.

Not the first difficult selling choice I've had to make. Won't be the last. TIPS generate plenty of inflationary gains but not all that much current income, savings bonds generate no income until cashed out, but the ongoing expenses continue to mostly come at night, mostly.

I intended to hold for many years, but what a difference a year makes. When I bought, the 10-year TIPS yielded -1.01%. Today, it yields +1.39%. I must admit that I never saw that coming. It's a game changer, at least temporarily, if nothing else.

That's not the main reason why I sold though. I needed to sell something in order to pay ongoing expenses. My choices were TIPS outside my retirement account, I-Bonds, EE-Bonds, and these coins.

I don't want to sell anything that would push up my income this year, because I still qualify for the health insurance subsidy of the Affordable Care Act. I also don't want to sell things that are generating inflationary gains with inflation running so hot.

So, as much as it pains me, the coins had to go (and some I-Bonds too, soon). At least I can put the capital loss to very good taxation use thanks to my other investments tied directly to inflation.

Not the first difficult selling choice I've had to make. Won't be the last. TIPS generate plenty of inflationary gains but not all that much current income, savings bonds generate no income until cashed out, but the ongoing expenses continue to mostly come at night, mostly.

Tuesday, September 27, 2022

Soft Landing?

The following chart shows the natural log of the median consumer price index. I have added a long-term trend channel in green and a short-term trend line in red.

If the green channel represents the runway and the red line represents our current flight path, then we'll be very lucky not to careen off into the wastelands.

If the green channel represents the runway and the red line represents our current flight path, then we'll be very lucky not to careen off into the wastelands.

Monday, September 26, 2022

Household Net Worth

The following chart shows the natural log of household net worth. When using natural logs, constant exponential growth is seen as a straight line. I have added a long-term trend channel in red.

Friday, September 23, 2022

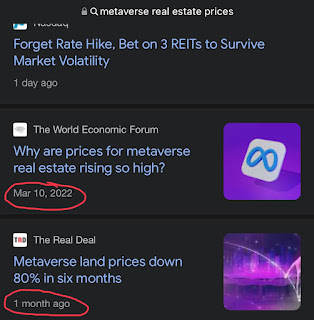

Metaverse Real Estate Gallows Humor

As seen in the image below, I just did an Internet search for "metaverse real estate prices" and I feel the need to share the results.

It's a rare treat to stumble upon such a rewarding gem. Do I keep searching? Do I read the two articles that I found? No, I'm good. I think my questions have been fully answered, lol.

This search was inspired by today's tweet from @MacroAlf:

Thoughts and prayers to people who took a mortgage to buy real estate in the Metaverse.

Mark Twain once said, "Buy land, they're not making it anymore." Too bad he's not still around to offer his thoughts on imaginary land, lol.

It's a rare treat to stumble upon such a rewarding gem. Do I keep searching? Do I read the two articles that I found? No, I'm good. I think my questions have been fully answered, lol.

This search was inspired by today's tweet from @MacroAlf:

Thoughts and prayers to people who took a mortgage to buy real estate in the Metaverse.

Mark Twain once said, "Buy land, they're not making it anymore." Too bad he's not still around to offer his thoughts on imaginary land, lol.

SPY vs. TLT

The following chart compares the investment performance of SPY to TLT, as a ratio between the two. I have added 3 trend channels in blue, red, and green.

Chart courtesy of StockCharts.com.

You're a true optimist if you believe any of the following::

1. There's any chance that we'll stay in the green channel long-term.

2. There's a reasonable chance that we'll stay well above the red channel long-term.

3. Entering the blue channel ever again would be absolutely, totally, and in all other ways inconceivable.

I'm not saying that you would necessarily be wrong to be a true optimist, and that the future we will find ourselves in truly could be the best of all possible worlds. However, I am saying that if you are a true optimist right now, at this moment, then I'd sure like to be smoking what you're smoking!

I am not an optimist. You can try to pry the shares of TLT from my cold dead fingers, but I'm not dead yet. Might seem that way as I patiently wait for trends to break though! Trends break. That's what they do. And each time the Fed raises rates, it puts us one step closer to the edge.

Chart courtesy of StockCharts.com.

You're a true optimist if you believe any of the following::

1. There's any chance that we'll stay in the green channel long-term.

2. There's a reasonable chance that we'll stay well above the red channel long-term.

3. Entering the blue channel ever again would be absolutely, totally, and in all other ways inconceivable.

I'm not saying that you would necessarily be wrong to be a true optimist, and that the future we will find ourselves in truly could be the best of all possible worlds. However, I am saying that if you are a true optimist right now, at this moment, then I'd sure like to be smoking what you're smoking!

I am not an optimist. You can try to pry the shares of TLT from my cold dead fingers, but I'm not dead yet. Might seem that way as I patiently wait for trends to break though! Trends break. That's what they do. And each time the Fed raises rates, it puts us one step closer to the edge.

Tuesday, September 13, 2022

Food at Home

The following chart shows the natural log of the consumer price index for food at home. When using natural logs, constant exponential growth is seen as a straight line. I have added a long-term trend channel in green, a steeper short-term trend line in blue (heading into the Great Recession), and an even steeper short-term channel in red (our current trajectory).

The stock market sure doesn't like it. Not one bit. Isn't feeling all that confident about a soft landing. Starting to wonder why the captain's warning of "some pain" while wearing a parachute?

It's not all bad news. Hey, at least we're sitting in the middle of the long-term trend channel. Small comfort, I know.

The stock market sure doesn't like it. Not one bit. Isn't feeling all that confident about a soft landing. Starting to wonder why the captain's warning of "some pain" while wearing a parachute?

It's not all bad news. Hey, at least we're sitting in the middle of the long-term trend channel. Small comfort, I know.

Monday, September 12, 2022

Illusion of Rationality

The following chart compares the yield of the 20-year Treasury bond (in black) to the average of the 10-year and 30-year Treasury bonds (in red).

Current Yields

10-Year: 3.37%

20-Year: 3.76%

30-Year: 3.53%

The 20-year Treasury bond currently yields a whopping 0.31% more than the average of the 10-year and 30-year Treasury bonds. How likely is that rational?

You could use rational arguments to convince me to sell TLT and take my losses, but don't you dare tell me to sell 20-year Treasury bonds and buy 10-year and 30-year Treasury bonds instead, while simultaneously p$*sing down my back while claiming it's raining. No sir, of all the bonds I'd think about selling right now, the 20-year Treasury bond would be near the very bottom of the list. But hey, maybe that's just me.

Current Yields

10-Year: 3.37%

20-Year: 3.76%

30-Year: 3.53%

The 20-year Treasury bond currently yields a whopping 0.31% more than the average of the 10-year and 30-year Treasury bonds. How likely is that rational?

You could use rational arguments to convince me to sell TLT and take my losses, but don't you dare tell me to sell 20-year Treasury bonds and buy 10-year and 30-year Treasury bonds instead, while simultaneously p$*sing down my back while claiming it's raining. No sir, of all the bonds I'd think about selling right now, the 20-year Treasury bond would be near the very bottom of the list. But hey, maybe that's just me.

Wednesday, August 31, 2022

The Clown Horn Report v.003

August 31, 2022

CNBC: Who wants to be a billionaire? 6 in 10 Americans strive to be mega-wealthy, report finds

Six in 10 adults say they even want to become a billionaire one day, according to a recent report.

If 60% of Americans get their wish, then hello hyperinflation. Talk about unintended wish consequences.

Some 44% of U.S. adults believe they have the available tools to become billionaires, largely fueled by speculative investments such as cryptocurrencies, according to the Harris Poll’s recent Americans and Billionaires Survey.

Gone is the old school illusion of prosperity era. All hail the new and improved delusion of prosperity era! 44% can't be wrong!!

CNBC: Who wants to be a billionaire? 6 in 10 Americans strive to be mega-wealthy, report finds

Six in 10 adults say they even want to become a billionaire one day, according to a recent report.

If 60% of Americans get their wish, then hello hyperinflation. Talk about unintended wish consequences.

Some 44% of U.S. adults believe they have the available tools to become billionaires, largely fueled by speculative investments such as cryptocurrencies, according to the Harris Poll’s recent Americans and Billionaires Survey.

Gone is the old school illusion of prosperity era. All hail the new and improved delusion of prosperity era! 44% can't be wrong!!

Friday, June 3, 2022

Retail Trade Employment per Capita

The good news, if you can call it that, is that we've managed to climb back to the declining trend line in red. Here's the reaction from our cat Dexter:

It's the same look he has when hunting buggies, birbs, bees, and bagholders. Okay, maybe not bagholders. He's just a cat, not a Wall Street professional trader. In a world of predators, it's easy to forget that.

In all seriousness, it would be an understatement to say that I am not optimistic about where retail trade employment heads from here. The short-term recovery tailwinds are gone. The long-term automation headwinds remain. May we live in dangerously interesting times. Sigh.

Thursday, May 26, 2022

The Sarcasm Report v.290

May 26, 2022

Gizmodo: California Startup Raises $13 Million to Harvest Platinum From Asteroids

Tempting investment idea, but wouldn't it be better to invest just 442 bitcoin (at $29,420 each) to harvest more bitcoin right down here on earth?

If there's one thing this world really needs, it's even more cryptocurrency.

Gizmodo: California Startup Raises $13 Million to Harvest Platinum From Asteroids

Tempting investment idea, but wouldn't it be better to invest just 442 bitcoin (at $29,420 each) to harvest more bitcoin right down here on earth?

If there's one thing this world really needs, it's even more cryptocurrency.

Wednesday, May 18, 2022

How Bad Could It Get?

The following chart shows the natural log of household and nonprofit net worth divided by the consumer price index. When using natural logs, constant exponential growth is seen as a straight line.

The future's so bright, I gotta wearshades night vision goggles.

The future's so bright, I gotta wear

Friday, May 6, 2022

Producer Price Index

The following chart shows the natural log of the producer price index for all commodities. When using natural logs, constant exponential growth is seen as a straight line.

We've been screaming towards the top of the channel like a runaway train. Our engineer (the Fed) is now desperately attempting to apply the brakes. The odds of a soft train landing seem incredibly low. Beware the rapidly approaching Deadman's Economy Curve. We're likely to derail!

Some might argue that we've already derailed. The worst is now behind us. I'm not convinced. Since when has maximum pain been achieved with near record low unemployment? It seems to me that we still have plenty of pent-up depressionary pain potential. Surely the unemployment rate has not achieved a permanently low plateau, especially given all the financial pain both the stock and bond markets have recently dished out. In fact, it's entirely possible that the pain party might just be getting started. Perhaps the Great Recession will be followed up with an even greater one. *cringe*

This is definitely not financial advice. I am and have been very concerned about our long-term future, much like many must have been during the fall of the Roman Empire. Who is responsible? We all are.

No single raindrop believes it is to blame for the flood.

We've been screaming towards the top of the channel like a runaway train. Our engineer (the Fed) is now desperately attempting to apply the brakes. The odds of a soft train landing seem incredibly low. Beware the rapidly approaching Deadman's Economy Curve. We're likely to derail!

Some might argue that we've already derailed. The worst is now behind us. I'm not convinced. Since when has maximum pain been achieved with near record low unemployment? It seems to me that we still have plenty of pent-up depressionary pain potential. Surely the unemployment rate has not achieved a permanently low plateau, especially given all the financial pain both the stock and bond markets have recently dished out. In fact, it's entirely possible that the pain party might just be getting started. Perhaps the Great Recession will be followed up with an even greater one. *cringe*

This is definitely not financial advice. I am and have been very concerned about our long-term future, much like many must have been during the fall of the Roman Empire. Who is responsible? We all are.

No single raindrop believes it is to blame for the flood.

Saturday, April 30, 2022

Sunday, April 24, 2022

Thursday, April 21, 2022

Like Roths to the Flame

Chart courtesy of StockCharts.com.

Chart courtesy of StockCharts.com.

Safety seeking momentum traders have clearly fled long-term government bonds and piled into the riskier bond alternatives of consumer staples and utilities. The dividend yields are now SO low, even as long-term bond yields have sharply risen. In my opinion, it will someday end in tears. Think consumer staples [Hostess Brands] can't ever go bankrupt? That there isn't intense competition within the sector? Think utilities [California's Pacific Gas and Electric Company] can't ever go bankrupt? Good luck on those theories.

In order to invest in either stock market sector now I'd need to be compensated for the extra risk. As a recent investor in both sectors, just not seeing the future rewards any longer. At all. In the last few months, it's been like a wild train ride to crazy town. Want absolutely no part of it. The bargains are gone and all that's left is empty momentum driven euphoria. Just an opinion, of course. Can't speak of your opinion on the level of this insanity. Perhaps, unlike me, you feel that relative parabolic moves higher are now the new normal? All I can say is heaven help us all if you are right.

Chart courtesy of StockCharts.com.

Safety seeking momentum traders have clearly fled long-term government bonds and piled into the riskier bond alternatives of consumer staples and utilities. The dividend yields are now SO low, even as long-term bond yields have sharply risen. In my opinion, it will someday end in tears. Think consumer staples [Hostess Brands] can't ever go bankrupt? That there isn't intense competition within the sector? Think utilities [California's Pacific Gas and Electric Company] can't ever go bankrupt? Good luck on those theories.

In order to invest in either stock market sector now I'd need to be compensated for the extra risk. As a recent investor in both sectors, just not seeing the future rewards any longer. At all. In the last few months, it's been like a wild train ride to crazy town. Want absolutely no part of it. The bargains are gone and all that's left is empty momentum driven euphoria. Just an opinion, of course. Can't speak of your opinion on the level of this insanity. Perhaps, unlike me, you feel that relative parabolic moves higher are now the new normal? All I can say is heaven help us all if you are right.

Tuesday, April 19, 2022

Trading Update X

In my IRA, all in on TLT @ $119.20. No longer sitting in cash awaiting opportunities. Long-term interest rates have reached the level I predicted in March of 2021. The 20-year bond looks to be the best bargain of the bunch, perhaps because TLT is now so unloved by retail investors and has a similar maturity.

The following chart shows the natural log of the 20-year Treasury bond yield. When using natural logs, constant exponential growth (or in this case, decay) is seen as a straight line. We have reached the trend line in red.

As is usual with my investments, this is intended to be a long-term holding. There's a lot of risk here, but if I am right about the particular path of our long-term future, then I feel pretty good about it. Well, as good as I could feel believing in an illusion of prosperity anyway. Counting on the Fed to engineer some sort of a landing. I do expect the plane to touch the ground again. Hindsight may easily show that touch was way too gentle a word though.

Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected. - George Soros

The following chart shows the natural log of the 20-year Treasury bond yield. When using natural logs, constant exponential growth (or in this case, decay) is seen as a straight line. We have reached the trend line in red.

As is usual with my investments, this is intended to be a long-term holding. There's a lot of risk here, but if I am right about the particular path of our long-term future, then I feel pretty good about it. Well, as good as I could feel believing in an illusion of prosperity anyway. Counting on the Fed to engineer some sort of a landing. I do expect the plane to touch the ground again. Hindsight may easily show that touch was way too gentle a word though.

Markets are constantly in a state of uncertainty and flux and money is made by discounting the obvious and betting on the unexpected. - George Soros

Friday, April 8, 2022

Brace for Impact

The following chart shows the natural log of the consumer price index for food and beverages. When using natural logs, constant exponential growth is seen as a straight line. I have added green and red trend lines to show how the growth has changed.

This is your captain. While a soft landing is still theoretically possible, please brace for impact. Place your feet firmly on the floor, tuck your arms and elbows close to your sides, bend over your thighs as tightly as possible, and tuck your head as closely as possible to the surface you are most likely to strike when slammed forward. Thank you for choosing to fly with Federal Reserve Airlines. We hope you have enjoyed your flight, the upcoming landing notwithstanding.

This is your captain. While a soft landing is still theoretically possible, please brace for impact. Place your feet firmly on the floor, tuck your arms and elbows close to your sides, bend over your thighs as tightly as possible, and tuck your head as closely as possible to the surface you are most likely to strike when slammed forward. Thank you for choosing to fly with Federal Reserve Airlines. We hope you have enjoyed your flight, the upcoming landing notwithstanding.

Friday, January 28, 2022

Household Net Worth

Behold the household wealth creation of a pandemic combined with ZIRP. Broken window fallacies be damned. Break them, and break them good I say. It's a brand new era of unprecedented prosperity! And should this plan ever start to falter, look for plague, pestilence, and NIRP to save the day!!

Seriously. Other than recent bitcoin and stock market performance, there's absolutely no reason to fear downside risk or reversion towards the mean theories. Even in uncharted territory, the Fed always knows what it's doing. Always has your back!

I know I said I was serious in the last paragraph. It was gallows humor. Sorry about that. I actually just bought more I-Bonds. Not only do they track inflation as seen in the CPI, but they can never deflate. Not that many are all that worried about deflation again. Yet.

Saturday, January 22, 2022

Thursday, January 20, 2022

Risk Off Is Not a Recent Development

The following chart shows how utilities are performing relative to the Nasdaq over the past 6 months. Note that utilities have been outperforming the Nasdaq since Halloween, which oddly enough is the same time I decided to go on a diet. Pure coincidence? Or is it all part of the same risk off mindset? I cannot say.

Chart courtesy of StockCharts.com

First they came for the Nasdaq

And I spoke out

Because the Internet really needs more bloggers stating the obvious

Here's something less obvious. Next they came for utilities? Interest rates have risen. The spread between utility dividends and the yield on the 10-year Treasury bond is dangerously narrow. Those who bought utilities as a bond replacement (such as myself) should be finding less value there now. For what it is worth, it is that narrowing spread in "safe stocks" that triggered my flight to safety just 10 days ago. The situation has definitely not improved.

Plenty of risk out there and not much value. Doesn't feel at all like it did through most of 2021. The headwind to tailwind ratio has increased dramatically.

Chart courtesy of StockCharts.com

First they came for the Nasdaq

And I spoke out

Because the Internet really needs more bloggers stating the obvious

Here's something less obvious. Next they came for utilities? Interest rates have risen. The spread between utility dividends and the yield on the 10-year Treasury bond is dangerously narrow. Those who bought utilities as a bond replacement (such as myself) should be finding less value there now. For what it is worth, it is that narrowing spread in "safe stocks" that triggered my flight to safety just 10 days ago. The situation has definitely not improved.

Plenty of risk out there and not much value. Doesn't feel at all like it did through most of 2021. The headwind to tailwind ratio has increased dramatically.

The Sarcasm Report v.289

Apple added trend analysis to their Health app. The added functionality really helps me understand what's actually going on. No longer must I guess at the direction my weight is heading.

Here's my weight over the past month:

Very disappointing month. I was under the impression that I was losing weight, but when a $2.7 trillion company says there is no discernable trend downward even as I walk 9+ miles per day and count calories, I have no choice but to concede that they must be right. Any optimism I once had has been replaced by a feeling of complete hopelessness. It's the kind of hopelessness that only a few quarts of ice cream could temporarily undo.

Here's my weight over the past 6 months:

Once again, my assumptions are found to be lacking. I was under the misguided impression that I started losing weight at Halloween, as a defiant response to leftover candy and a long-term trend that I finally decided to reverse. That could not be farther from the truth. As seen in the professional trend analysis, my quest actually began just 7 weeks ago. While not the good news that I had hoped, at least there is some hope here. It does shatter my self-confidence to be that far off on the timing though.

The future is bright. I'm looking forward to the day when this trend analysis technology can be applied to investments, and you should too. Can you imagine all the money we'd make being able to spot new trends in real time? I wouldn't expect Apple to provide professional tools for free though. They will most likely monetize it. But still, there should be so much money rolling into our investment portfolios that we won't care in the slightest. That's a win win for both Apple and us!

Monetize is such an awesome word. What a great day it is to be able to work monetize into a post! Monetize! Monetize! Monetize! All the world is our monetized oyster! Woohoo!

And lastly, there are other obvious uses for this trend analysis technology. For example, full self-driving cars clearly need to understand the movement trends of the objects around them. In real time! Now that weight trend analysis has been mastered, how hard can it be?

Here's my weight over the past month:

Very disappointing month. I was under the impression that I was losing weight, but when a $2.7 trillion company says there is no discernable trend downward even as I walk 9+ miles per day and count calories, I have no choice but to concede that they must be right. Any optimism I once had has been replaced by a feeling of complete hopelessness. It's the kind of hopelessness that only a few quarts of ice cream could temporarily undo.

Here's my weight over the past 6 months:

Once again, my assumptions are found to be lacking. I was under the misguided impression that I started losing weight at Halloween, as a defiant response to leftover candy and a long-term trend that I finally decided to reverse. That could not be farther from the truth. As seen in the professional trend analysis, my quest actually began just 7 weeks ago. While not the good news that I had hoped, at least there is some hope here. It does shatter my self-confidence to be that far off on the timing though.

The future is bright. I'm looking forward to the day when this trend analysis technology can be applied to investments, and you should too. Can you imagine all the money we'd make being able to spot new trends in real time? I wouldn't expect Apple to provide professional tools for free though. They will most likely monetize it. But still, there should be so much money rolling into our investment portfolios that we won't care in the slightest. That's a win win for both Apple and us!

Monetize is such an awesome word. What a great day it is to be able to work monetize into a post! Monetize! Monetize! Monetize! All the world is our monetized oyster! Woohoo!

And lastly, there are other obvious uses for this trend analysis technology. For example, full self-driving cars clearly need to understand the movement trends of the objects around them. In real time! Now that weight trend analysis has been mastered, how hard can it be?

Friday, January 14, 2022

Fed Chairman Boromir

It is a strange fate that we should suffer so much fear and doubt over so small a thing. - Boromir, The Lord of the Rings

Monday, January 10, 2022

Trading Update IX

Closed all positions within my IRA. Sitting in cash.

Down 0.15% for the day, up 2.98% in 2022, and up 21.10% since I bought stocks in late December of 2020. (I'm also owed some dividends from all 3 tobacco stocks.)

I patiently await new opportunities. It is my hope that real rates will continue to rise and my next investment will be long-term inflation protected Treasury bonds (my preferred "safe" investment).

Right or wrong, this liquidation was triggered by the narrowing spread between the dividend yield on VPU (utilities fund) and the yield on the 10-year Treasury bond. At roughly 1%, it's way too narrow for my liking. Since I've earned more than the equivalent of a 10-year Treasury bond held to maturity (in just one year), I feel no great need to push my luck.

Side note: XBI continued to crash. Was my worst performer, by far, and I'd only held it two weeks.

Down 0.15% for the day, up 2.98% in 2022, and up 21.10% since I bought stocks in late December of 2020. (I'm also owed some dividends from all 3 tobacco stocks.)

I patiently await new opportunities. It is my hope that real rates will continue to rise and my next investment will be long-term inflation protected Treasury bonds (my preferred "safe" investment).

Right or wrong, this liquidation was triggered by the narrowing spread between the dividend yield on VPU (utilities fund) and the yield on the 10-year Treasury bond. At roughly 1%, it's way too narrow for my liking. Since I've earned more than the equivalent of a 10-year Treasury bond held to maturity (in just one year), I feel no great need to push my luck.

Side note: XBI continued to crash. Was my worst performer, by far, and I'd only held it two weeks.