The headlines are dominated by talk of robust GDP growth during the recovery. Thought it might be a good time to offset that with a few charts of real GDP reality.

Here is a short-term chart of the natural log of real GDP. When using logarithms, constant exponential growth is seen as a straight line.

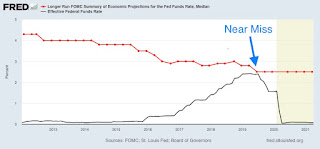

Note that, thanks to the virus, we failed to stay in the green channel. We're currently throwing everything at real GDP, including the kitchen sink, just in an attempt to get back to where we were. Also note that real GDP growth was weakening before the virus even hit. The Fed raised rates in 2017 and 2018. In 2019, the Fed was forced to backtrack on that plan. In hindsight, a rate of 2.4% was too draconian. The Fed ended the year at only 1.6%. And then, the virus hit.

So, in the short-term, we're definitely attempting to claw our way back to that green trend channel. But what about long-term?

The red channel is where we once were. That ship has sailed. No hope of ever getting back to it, especially now that we have a Covid baby bust. That exponential trend failed spectacularly, leaving us with a new green channel. The green channel then failed too. Cascading exponential trend failures. That's where we are now.

Here's the good news. We're all in this perma-ZIRP handbasket together and some of us strongly suspect where we are headed. Brush up on your Japanese and enjoy the ride! We might not like the ultimate destination all that much, but the path to get there is filled with easy money. And when I say easy money, I'm not expecting retired savers patiently waiting for interest rates to "normalize" to someday make out like bandits. This isn't a Hollywood movie. If anything, it's more like Gilligan's Island. Being stuck at zero is normal. Interest rates have been exponentially decaying for 40 years. It's just more of the same.