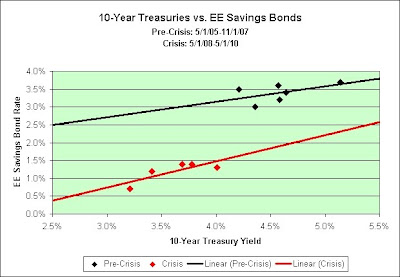

EE Bonds issued May 2005 and after earn a fixed rate of interest. The fixed rate is determined by adjusting the market yields of the 10-year Treasury Note by the value of components unique to savings bonds, including early redemption and tax deferral options.

Rates for new issues are adjusted each May 1 and November 1, with each new rate effective for all bonds issued in the six months following the adjustment.

EE Savings Bonds currently yield 1.4%. The 10-Year Treasury Note rate was 3.69% when rates were last set back in May.

The 10-Year Treasury Note rate on 10/22/10 was 2.59%. That's a 1.1% drop and we should expect a similar drop in EE Savings Bonds.

I'm basing my prediction on the crisis trend line in the chart above. Based on today's rates, I'm guessing 0.5%.

There is also a possibility that the original maturity will increase. It is currently 20 years. EE Savings Bonds are guaranteed to double if held until maturity. That puts the current long-term rate at 3.53% (2^(1/20)=1.0353).

For what it is worth, I'm a buyer this week. I do not expect to hold it the full 20 years but I'd like to have the option. In the meantime, I'll be earning a better rate than my online savings account.

See Also:

I-Bond Rate Prediction for November 1st

Source Data:

FRB: Selected Interest Rates

3 comments:

What is the total amount of I-bonds & EE bonds that one can buy per year? $10,000?

You can buy $5,000 in electronic form through Treasury Direct and an additional $5,000 in paper form through many banks.

That was just for the one type of bond. Double that to $20,000 total if buying both types of bonds (4 seperate purchases of $5k each).

Post a Comment