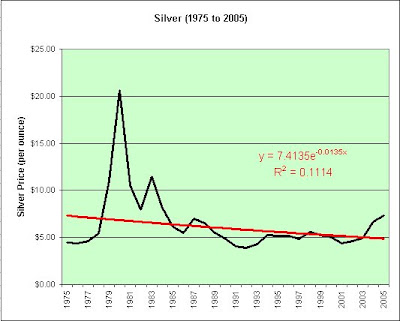

During the period, silver fell in price an average of 1.4% per year (not adjusted for inflation). To put it bluntly, it was a horrible investment. On the other hand, value can sometimes be found in the dumpster. I owned it from 2004 to 2006 and it treated me very well (up 60%).

Silver Statistics and Information

Silver has been used for thousands of years as ornaments and utensils, for trade, and as the basis for many monetary systems. Of all the metals, pure silver has the whitest color, the highest optical reflectivity, and the highest thermal and electrical conductivity.

Silver Thursday

Bunker and Herbert started investing in silver as a hedge against inflation and by 1980 it was estimated that they held one-third of the world's supply of the metal.

That certainly didn't end well. Silver has been a bit of a dog lately too. I think the new silver ETF pulled a "Bunker" on it as it had already come too far too fast (using hindsight anyway). The ETF came out just as the metals were reaching their parabolic peak back in 2006. The curse of silver strikes yet again!

I have included the price of oil and silver as of of September 3, 2007 as part of the data set in the following chart. It stands alone on the right side of the chart. You will note that it is not in the upper right corner like the other metals in this series. That shows just how bubbly it was back when the Hunt brothers were cornering the silver market.

Rather than try to explain the poor link between oil and silver (and its apparent very poor hedge against inflation), let me just offering the following thought.

The 1964 quarter is 90% silver. It has approximately 0.17875 ounces of silver in it. 43 years later, (at today's silver price of $12.10 per ounce), that quarter is worth $2.16.

The 2007 quarter has no silver in it at all. It is apparently worth 25 cents. What's it going to be worth in 43 years?

Maybe I'm just being overly sentimental, but the government stopped putting silver in the quarter the year I was born. That's just plain insulting no matter how I look at it, lol.

I bought silver for the same reason the Hunts Brothers did. With interest rates at 1% but inflation running hotter than that, I simply didn't trust my currency. Since silver was probably one of the most beaten up hard asset classes in the last 30 years, I basically went dumpster diving. I picked silver quarters. I didn't have to worry much about counterfeits. You know what a quarter is supposed to look like. Further, they come in handy "junk" bags and the transaction costs to buy and sell are fairly reasonable.

Warren Buffett also went dumpster diving on silver in the late 1990s. The weekend after I sold my silver he stated that he'd sold his. No joke! I was very nearly sweating bullets that weekend I assure you, not that it really mattered in hindsight. Silver has gone up in price a bit since then. Few seem to care what Warren Buffett has to say. He was worried about the tech bubble before it burst. He was worried about housing in 2005. He's been worried about the value of our dollar. Instead, we listen to financial news commentators. Why is that?

Value Investing's Notes on Berkshire Hathaway's 2006 Annual Meeting

We bought our Silver position too early and we sold too early.... But booms get wild towards the tail end. Its like Cindarella at the ball before the clock strikes midnight. You know that everything is definitely going to turn to pumpkins and mice so Cindarella should leave in advance. But you are having so much fun and the temptation is there to stay for just ONE MORE dance.

I think there was a lot of temptation in the housing market and that ball appears to be over.

Conclusion: If I had to pick a hard asset class to hoard, I'd probably go with silver again. However, I'm not looking to hoard hard asset classes right now. I'm stagflationary but in a treasury inflation protected securities way (since I can't seem to choose between deflation and inflation, but think slower growth is coming). I don't have much of an opinion on whether silver is worth its current price. I do not own it now. This is not investment advice.

No comments:

Post a Comment