Click to enlarge.

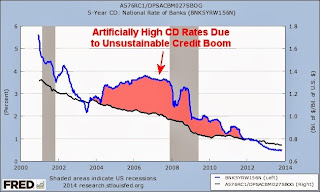

The line in blue shows the 5-year CD rate at commercial banks (left scale).

The line in black shows wages and salaries divided by deposits at commercial banks (right scale).

Here's the theory.

A lender's ability to lend is generally determined by the amount of their deposits (fractional reserve banking notwithstanding).

A lender's desire to lend is generally determined by the stable income streams of the borrowers (NINJA loans notwithstanding).

When wages (a bank's desire to lend) grow slower than deposits (a bank's ability to lend), then all things being equal (which they rarely are), the interest paid on deposits should fall (clearly seen in the chart). It's simply supply vs. demand. Not enough wages. Too many deposits.

Unlike nearly every financial expert on CNBC, I am not a believer that we're in a rising interest rate environment over the long-term. Wage growth is not keeping up with deposit growth. There are no signs of that trend changing any time soon (as seen in the declining black line in the chart). Why would I expect higher CD rates when there is a growing wage famine (nonfarm payroll employment) relative to a growing deposit glut (CPI adjusted deposits)? As seen in the following chart, note that this is a new development that began in February of 2000 (the peak in wages divided by deposits). In hindsight, Y2Katasrophe for the win!

Click to enlarge.

Inflation (or the lack of it) isn't really going to alter the dynamics much in my opinion. Banks aren't going to pay higher CD rates just because food costs more. I would be the last to argue that they're nonprofit food banks (Jamie Dimon sarcastically notwithstanding).

This is not investment advice. If it was, I would have written this post in Japanese as a tribute to Japan's popping housing bubble in the early 1990s and 20+ years of its ongoing low interest rate aftermath.

Source Data:

St. Louis Fed: Custom Chart #1

St. Louis Fed: Custom Chart #2

19 comments:

... Banks aren't going to pay higher CD rates ...

Banks may not be paying higher CD rates but........

.... They are giving money away...to anyone who wants it.

Chase is giving $150 to anyone who opens a savings account with $10K and keeps it balanced with $10K for 6 months and they will pay $125 for anyone who opens a checking account with $1500 and keeps it open with $1500 balance for 6 months.

Figure the effective interest rates on those.

And Bank of AmeriCON will pay $25 every 3 months to anyone who can qualify for and pay full balance each statement period on a newly opened credit card account of some certain variety.

Figure the interest rate on that.

(Japan notwithstanding).

I'm not exactly sure what your implication is regarding banks and CD rates but I'm pretty positive you and the banks are not on the same page when it comes to money and the masses.

Of course, I could be unequivocally wrong.

Fritz_O,

Your examples are all attempts to gain market share by enticing customers of other banks to switch. Banks are certainly willing to pay for that, especially in a slow real growth world.

What's the effective interest rate once all fees are considered?

March 29, 2013

Banks made $32 billion on overdraft fees last year

The Moebs study found that about a quarter of the people with a consumer checking account – that’s 38 million people – frequently overdraft. The median overdraft is about $40.

Once again, banks are hardly charity organizations. If they give people free cash they eventually expect to get it back.

...they will pay $125 for anyone who opens a checking account with $1500 and keeps it open with $1500 balance for 6 months.

Wouldn't it be interesting to see Chase's internal estimates on the percentage who will try and fail to keep a $1500 balance for 6 months.

June 24, 2013

76% of Americans are living paycheck-to-paycheck

Roughly three-quarters of Americans are living paycheck-to-paycheck, with little to no emergency savings, according to a survey released by Bankrate.com Monday.

These are also the most likely people to be enticed by $125 one would think. Sigh.

Wow - what a brave new world post Y2K. Seems like we should be jumping on the 30 year treasuries paying almost 4% since pretty soon we'll be Japan where they pay 1.7%. Somehow every fiber of my being fights against that. So what structural change happened at Y2K? Maybe the sudden proliferation of technology and software made labor less valuable and less needed overall? But that was already happening since the 1980s. Will this trend ever reverse? Economics is hard...

Fred

As a side note, banks made more than $100 per capita in overdraft fees in 2012. That's especially impressive considering that it includes babies (with no innate ability to overdraw checking accounts).

And a second question - where the heck are these deposits coming from if wages are down? Median incomes have decreased almost 10% since the beginning of the recession - so these folks aren't saving a lot. So, it must be the upper 10% or the rentiers receiving an increasing share and parking their money in savings accounts?

Fred

Fred,

Somehow every fiber of my being fights against that.

Tell me about it. I've even got Stagflationary in my name, lol.

As you may recall, I opted for long-term TIPS because I'm too much of an inflationary coward. I did dabble in EE Savings Bonds that I still intend to hold to maturity though (guaranteed to double if held 20 years). No complaints on any of the purchases so far.

I can't say with certainty what rates will do in the future. I just have a different opinion than those who believe with absolute certainty that long-term rates will rise from here. I scoff at the idea that any part of the future can be known with absolute certainty.

I offer an alternate theory and one I tend to believe in. That's all.

Fred,

In answer to your questions...

There are lots of reasons that household income has been struggling lately. Here's just one. We went from just having the father work to having both parents work. That boost is over. We'd need 3 to work now.

As for when the trend reverses, perhaps it's a bit like asking when the Roman Empire's trend will reverse. I hope not, but it could be. Sigh.

So, it must be the upper 10% or the rentiers receiving an increasing share and parking their money in savings accounts?

I do think income and wealth inequality has a lot to do with it. Keep in mind that it is hard to purchase a long-term TIPS bond and hold it to maturity if one is living paycheck to paycheck. At best, the poor earn far less on short-term savings. As they say, it takes money to make money.

Perhaps it could even be said that it takes money to take money (rentier logic).

...attempts to gain market share by enticing customers of other banks to switch. Banks are certainly willing to pay for that...

Yes, banks want new meat, even if it means canabalism. That does not change the fact that they are giving money away. That was my point.

What's the effective interest rate once all fees are considered?

What fees?

I can deposit, take my free gift, and leave. No fees.

What's your point?

If they give people free cash they eventually expect to get it back.

Yes, we all know banks are set up to provide free services to the rich at the expense of the poor. I'll provide examples.

I simple stated with proof that banks are giving money away. And they are. Period.

Wouldn't it be interesting to see Chase's internal estimates on the percentage who will try and fail to keep a $1500 balance for 6 months.

That's not what Chase wants to accomplish. What they want is to entice people into their bank via these carrots and then hope that because of their laziness they will become long term customers (suckers) and that the results will be fees gained.

Again, all I'm saying is that, despite all of this, bank are, in fact, giving money away to all of those who are disciplined enough to take it.

Who wouldn't take this money that the banks are giving away?

Believe it or not, I'm actually less worried about my long-term TIPS bonds than I once was.

I'll worry more when if and when the "experts" stop telling people that long-term interest rates can only go up from here.

Yeah, yeah. And dotcom stocks can only go up from here and real estate prices can only go up from here.

If there's one argument that always triggers alarm bells for me, it's the "____ can only go up from here" theory. How about some frickin' odds that aren't pegged at 100.00% for a change?

In other words, stop hard selling the "sure thing" crap.

When in doubt, bail out.

Fritz-O,

I can deposit, take my free gift, and leave. No fees.

Yes, you can. They expect you to be the exception, not the rule.

What's your point?

You pointed out how banks give money to customers. I pointed how banks take money from customers. In general, they take more than they give.

I simple stated with proof that banks are giving money away. And they are. Period.

I stated with proof that banks are taking moneys as fees. Neither of which has much to do with interest rates, unless you can show me that the typical customer is getting a lot more in cash perks than he's paying in bank fees.

My post was not about the money banks pay to attract a small number of new customers. It was about the interest they pay to the average customer.

Again, all I'm saying is that, despite all of this, bank are, in fact, giving money away to all of those who are disciplined enough to take it.

My post is not about the disciplined few, it is about the overall average.

Who wouldn't take this money that the banks are giving away?

I've certainly done it in the past. I remember moving a lot of my emergency savings to Washington Mutual during the housing bubble. There was a big sign on their bank stating that they were paying 4% on checking. It didn't stay there long though. You can probably guess why. I never got rid of my previous account. Didn't expect it to be long-term. Go figure.

Once again, my post is not about what a particular person can do to take advantage of cash bonuses and avoid fees. It's about what overall long-term interest rates may or may not do.

In my particular case, I cannot protect myself with $125 cash bonuses. I cannot scale it in proportion to my nest egg. I'm not at all suggesting that $125 isn't a great idea for a disciplined person though. I just don't think it has much of an impact on the trillions of dollars in bank deposits (from an interest rate perspective).

Fritz_O,

When in doubt, bail out.

The bull market in doubt started in 2000. Some argue that it recently ended, but I have my doubts. ;)

A fund manager over here, whose reports I read regularly, said that inflation-linked government bonds are an excellent investment if inflation continues/rises while interest rates stay low. I suppose that combination is the bet you've made, Mark. Have you bought any protection against different outcomes?

dearieme,

I bought TIPS as slowing real growth insurance. Real yields tend to match real growth.

That's pretty much the only outcome I've aligned myself to (and so far, no complaints).

I don't need protection against higher real growth. In fact, I root for it. I'm holding the bonds to maturity. If real rates rise, I will simply have lost the ability to have done better.

Further, I want real rates to rise so that when my bonds mature I can reinvest at higher rates. It doesn't seem likely to me though (at least over the long-term if I'm right about slowing real growth). Sigh.

Put another way, I'm betting on doom and gloom but will do better if I'm wrong. It's a bit like paying for health insurance. I don't root for a ruptured spleen just because I have insurance. ;)

Hyperinflation is one outcome that I have little defense against. If I tried to insure against every bad outcome, then I'd be spending my entire nest egg on insurance.

There is a cost for demanding absolute safety. I am not in a position where I can afford it. I therefore pick and choose my battles based on what I believe the odds to be (could very well be wrong of course.

I can say this though. If I am financially ruined in TIPS and I-Bonds, then I'll be taking stock market investors with me (there's no way they would not share in my pain). The same is not true in reverse. Another stock market bust won't affect me any more than the recent boom has more than likely.

A lender's ability to lend is generally determined by the amount of their deposits

For many smaller banks, yes. But, if you look at the balance sheet of a TBTF bank like Citi, you'll see that deposits are not the source of bank funding/lending. Bonds are used in lieu of deposits. During the crisis, the Gov't explicitly guaranteed the bond loans to TBTF banks.

When commercial banks create credit, they simultaneously create deposits. This is not the case when bank funding (matching really) comes from other sources such as bonds. In the case of bond funding, existing deposits are required to support more and more credit.

The "lendable" funds theory is bullsh%t. Commercial banks create credit. They don't search for funds that they can then lend out although many still pretend or believe that's how the system works.

Similarly, we don't have a fractional reserve banking system. No joke, Mish notwithstanding.

Reserve requirements are a mechanism to create demand for reserves. As new credit is created new reserves are needed. The Fed supplies the reserves to the system at a price. It is the demand for reserves that allows the Fed to set short interest rates.

Incidentally, if the Fed didn't supply the reserves as new credit was created, the Sh%t would hit the fan and the system would be in aggregate default. Only the Fed can create new reserves. And reserves never, ever, ever, leave the banking system. Currency is not reserves.

In this light, QE and trillions in excess reserves is a goofy, roundabout way of lowering long term rates. It does create speculation though which could be it's actual underlying purpose.

Imo, the five year treasury is very attractive right now. Seriously, why would anyone buy a 5 year bank CD when they can buy a higher yielding, more liquid and safer 5 year treasury?

Cost of funds (ZIRP) is a manipulated sham designed to help banks. That said, manipulating long term rates lower actually hurts banks.

From where I sit, it's a workable system that is being run for the benefit of crooks.

mab,

For what it is worth, my dad was a bank manager at US Bank when I was a kid (Old National Bank back then).

One day, a customer (farmer) came in and paid off his $250k loan with his $250k savings account.

It was not a good day for my dad. His "superiors" felt he should have tried to talk the customer out of it. $500k in accounts lost in one day.

I'd never seen my dad so frustrated by his job. Upper management was very displeased. There was no way he was going to attempt to talk the customer out of it. It was a perfectly rational thing to do (especially with 1970s/1980s era interest rates).

That was my first real glimpse at the inner workings of being employed by the banking "man." Perhaps that has something to do with my goal from an early age to strive for early retirement.

Perhaps that has something to do with my goal from an early age to strive for early retirement.

You saw the light early compared to most. Lucky!

To me, it's amazing there's so little understanding about how our banking/financial system works. How can this be so? Seriously, it's simple as pie. Hussman, Mish, Denninger, ......all have fundamentally flawed views.

Gov't "debt", rising interest rates, bond vigilantes, bah!

Propaganda clearly plays a role in keeping people confused. But I think that somewhere along the way, religious thinking was allowed to be infused into the system. This helps explain how the propagandists can exploit and perpetuate the ignorance and confusion.

The CONfusion ain't an accident that's for sure. A simple speech by the Fed chairman would end the stupidity tomorrow. Not gonna happen though.

Perpetual ignorance for the win!

Post a Comment