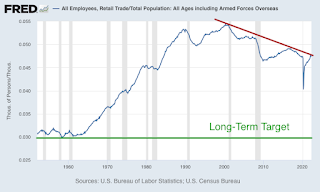

The good news, if you can call it that, is that we've managed to climb back to the declining trend line in red. Here's the reaction from our cat Dexter:

It's the same look he has when hunting buggies, birbs, bees, and bagholders. Okay, maybe not bagholders. He's just a cat, not a Wall Street professional trader. In a world of predators, it's easy to forget that.

In all seriousness, it would be an understatement to say that I am not optimistic about where retail trade employment heads from here. The short-term recovery tailwinds are gone. The long-term automation headwinds remain. May we live in dangerously interesting times. Sigh.

18 comments:

Strega is unavailable to concur with Dexter. (Had to put her down yesterday - cancer, kidney infection, ulcerated stomach.)

I'm wondering if that's a momentary blip due to creation of new businesses desperately trying to tap into the portions of the laptop class that are now working from the suburbs. If so, it will drop below trend later this year as those businesses fail under inflation and supply chain pressure.

I am so sorry about your pet. In a perfect world, pets would always be healthy and live as long as we do. We don’t live in a perfect world though, and it’s getting less perfect as time goes on and/or I’m becoming more cynical as I get older.

I’ve been feeling my own mortality lately. It’s a mild form of a midlife crisis, not that 57 is actually a likely midpoint. Of course, it beats living forever. That would be the ultimate curse. An eternity is way too long if one factors in the finite lifespan of our sun. Would be interesting to see 10,000 years in the future though. Do humans survive that long? Or did World War [Insert Large Number Here] finish us all off?

Got a chart to show the long-term effects of the go-forth-and-multiply strategy?

No one gets out of life alive.

Here’s an exponentially be-fruitful-and-multiply log chart of US population.

https://fred.stlouisfed.org/graph/fredgraph.png?g=Qffz

I must confess that we have not done our part to keep the constant exponential growth trend alive. We have no human kids, and even our fur babies won’t be reproducing.

https://www.npr.org/sections/goatsandsoda/2020/06/14/876002404/locusts-are-a-plague-of-biblical-scope-in-2020-why-and-what-are-they-exactly

Demographic slowdown seems to be a feature of mature nation-states. The US has been doing better than others due to higher immigration (+0.7%). It's worse in Germany (-0.21), and even worse in Japan (-0.37). Africa is booming.

source: https://en.wikipedia.org/wiki/List_of_countries_by_population_growth_rate

When you say that we are a mature economy, I assume you don’t mean this:

https://youtu.be/uZA_t9RpULQ

The children you didn't have won't be tormented by living in a world without social security and retail jobs.

I sometimes think the best thing I never did was a bring a kid into this world. Not proud of it, just turned out that way.

Yeah. I hear you. The best thing I never did was bring children into this world with my ex-wife. Not proud of it either, but I do feel like I dodged a bullet. Knew enough to know children weren’t going to solve a relationship slowly spiraling into the abyss.

You picked a good time to exit the market!

Great Unknown,

Hindsight is being very kind.

If one must panic, at least panic first. Never be among the last to panic.

Strategy works in crowded movie theaters when there’s smoke. Also apparently works in the stock and bond markets when there’s excess exuberance, near record low unemployment, and rising inflation. *cringe*

No new post in over 2 months? Apparently we hit PEAK sarcasm in early June! Hope all is well and you’re just at the Hamptons for the summer with all the other rich guys.

Hey Great Unknown,

Been too busy to post. Been sorting through all these documents from some guy claiming to be a former president. Like I’m buying that! The return address is some sort of golf motel in Florida! Why me, I ask him? All I got back was this reply:

https://m.youtube.com/watch?v=iThtELZvfPs

In other more serious news, your timing is nearly perfect. Nice to hear from you. We lost a pet a few days ago. Our parrot passed away. Had her about 16 years (and was about 10 years old when we got her). Kind of sad, somber, and quiet around here.

As for posting, not much to say. Sitting on a small loss on my fairly recent TLT purchase. Feels like it might be the calm before the $@&#storm. Or not. Uncertainty about the future is certainly elevated.

2020? Not so good.

2021? Not so good.

2022? Not so good.

2023? Sarcastically optimistic! ;)

Hope all is well with you and yours.

Sorry to hear about the loss of your parrot. It is true that the passage of time helps reduce the pain.

Yep. I’m at a small loss on TLT as well. For one shining moment I was at break-even though. Fortunately, I know I’m often wrong so I dollar-cost average into positions now. I started picking up some more last week to reduce my cost basis. I’ve even thrown caution to the wind and ventured into ZROZ.

But I’m pretty close to having as much of a TLT/ZROZ allocation as I want and leaning towards building cash right now. I suspect the illusion pf prosperity is going to collapse again in a few months, but recognize that it’s impossible to know. (If I could be right 51% of the time, I’d be a Las Vegas high roller instead.)

Anecdotal evidence to support the illusion of prosperity claim:

Three of my closest neighbors are all doing big home improvement projects right now. My closest neighbor even has a honey bucket in their driveway and it’s been there for months. Unprecedented activity.

The wealth effect’s punch bowl has clearly been overflowing. Doesn’t seem all that sustainable. Continuing to brace for a punch bowl drought. Not there yet but there are plenty of signs that it’s coming shortly.

Or not. As you say, it’s impossible to know for sure. It’s always about how much money we make when we are right vs. how much we lose when we are wrong. I once primarily focused on the former but now focus on the latter. Was lucky on risk taking when I was younger. No need to take big risks any longer. Some might say TLT is a big risk, but if TLT goes down big from here then there won’t be much of an economy left. Even the safety of cash needs a functional economy, otherwise it’s just useless paper.

Two ways we could be wrong on TLT. We’re too bearish (no collapse) or not nearly bearish enough (everything collapses)! These are very dangerous times for those trying to protect capital. Sigh.

Have you broken out the swamp cooler this year?

Anonymous,

The swamp cooler has been retired.

1. Although it’s been hot this year, it hasn’t been unbearably hot. Expected to hit 90 today, but the house is starting off at a more than pleasant 64 degrees, thanks to 2 industrial fans we use every year to rid the house of hot air overnight. Of course, that only works if the nights are cool (unlike the swamp cooler year with its record shattering 100+ degree days and 70+ degree nights).

2. There’s now a portable window air conditioner in the bedroom, so there’s a place to go for relief. We’ve used these in the past but they tend not to have a very long lifespan. “Maybe this time it’s different.” *cringe*

3. I’ve lost a lot of weight since the swamp cooler year (more than 10% lighter and hovering at the top end of a healthy weight range). My tolerance for excessive heat has therefore improved substantially.

How are you holding up? Located in harm’s way or are you outside this year’s inferno zone?

Good question. July electric bill largest in 21 years at the same house! (although some of that is due to recent rate increases)

Nearest large city to us about 30 miles away had hottest May and June in history!

If we could chart the sun's intensity I'm thinking it would resemble the trajectory of our national debt.

https://www.pbs.org/newshour/amp/show/as-price-of-natural-gas-surges-so-do-household-energy-bills

As they say in Game of Thrones, “Winter is coming.”

Post a Comment