Sunday, February 28, 2021

TV Show Idea: Soap Bubble

With record low housing inventory, record low mortgage rates, a Fed committed to ZIRP for the foreseeable future, and a potential permanent increase in working from home, an acceleration of the downward trend in the chart seems inevitable to me.

Will history repeat? Will 2010 to 2027 play out exactly like 1990 to 2007? Will our next financial crisis be another housing bubble disaster? Will the Fed step in to save the economy with even more ZIRP in 2027? Will long-term Treasury yields continue to temporarily scream higher in a futile effort to resist the overwhelming long-term deflationary forces?

Tune in next week for another exciting episode of Soap Bubble!

Saturday, February 27, 2021

The Lords of Land

We can't all be the lords of land. At some point, there would be a landlord glut. Might already be there.

The Sarcasm Report v.282

When using a credit card to buy bitcoin, what's the worst that can happen when you profit every time?

Friday, February 26, 2021

VPU Performance v.002

Months Elapsed: 2

Total Growth: -4.59%

Annualized Growth Rate: -24.59%

Wednesday, February 24, 2021

Consumer Prices Have Grown Linearly Since 1982

It is very interesting, at least to me, that prices have consistently been growing linearly (and not exponentially). On average, the consumer price index has been growing by about 4.4 points per year. Was true when the index was only 100. Was still true when the index exceeded 250.

Should the trend continue, the average growth rate of 1.72% per year over the last decade will fall to 1.56% over the next decade.

Of course, the trend won't necessarily continue. And if it doesn't continue, which way will it fail?

I'm leaning heavily towards eventually failing to the downside like Japan. Even if I am ultimately right (certainly not a given), eventually is a very hard thing to time. *shrug*

Source Data:

St. Louis Fed: CPI

Sunday, February 21, 2021

The 30 Trillion Dollar Elephant in the Room

We are now $30 trillion below the consumer debt trend that was in place for 55 years. Ben Bernanke once said that credit is the lifeblood of our economy. The lifeblood is certainly not pumping like it once did. Is it any wonder that Janet Yellen is practically begging for more fiscal stimulus?

While others talk of an economy that will soon temporarily overheat, I ponder what this elephant's continuing long-term impact on real GDP growth will be and if yet another elephant will appear in a post-pandemic world.

See no elephants, hear no elephants, speak no elephants.

Source Data:

St. Louis Fed: Households and Nonprofit Organizations; Debt Securities and Loans; Liability, Level

Wednesday, February 17, 2021

3.2%

If the long-term exponential decay of the 30-year Treasury bond yield (in red) continues, then the current rise in the yield should max out at no more than roughly 3.2%.

As seen in the yellow line, the long-term trend (in red) and the short-term trend (in green) meet at about 1.17.

e1.17 = 3.2

Declaring that the long-term bull market in long-term Treasuries is over while the natural log of the yield is well below the red trend line seems more than a bit premature to me. Where's the evidence of the bull market's demise?

So, now we wait. Will the line in the sand hold at 3.2%? I think it will but I wouldn't bet my life on it. If it does not hold, things are going to get very interesting. And when I say interesting, I actually mean terrifying. I don't think that our increasingly leveraged consumer society would know how to cope with mortgage rates that no longer fall over the long-term.

Our increasingly leveraged consumer society isn't a bug. It's a feature. It's buy design. (Pun intended.)

Monday, February 15, 2021

Peak Gambling?

On the one hand, traditional gambling peaked in 2007 at 1.126% of personal consumption expenditures.

On the other hand, this chart doesn't show bitcoin, Tesla, GameStop, and record margin debt.

Sunday, February 14, 2021

Pent-Up Demand Destruction (Musical Tribute)

Used to take one

Now it takes four

You don't get me high anymore

Saturday, February 13, 2021

During Pandemic, Millionaire Regrets Not Having More Money

February 11, 2021

Millionaire who bought a home at 26 regrets paying off his mortgage early: 'This is the biggest downside no one tells you'

After being mortgage-free, my and wife and I lived comfortably off the severance checks that we negotiated when we quit our six-figure jobs in finance (by that time, we had amassed a net worth of $3 million), and the $150,000 in annual passive income — mostly from real estate, dividend stocks and bonds.

But my entire attitude slowly changed once I sent that final mortgage check. I stopped aggressively looking for new freelance consulting work. I went from taking on three contracts per month to just one. So instead of working 60 hours, I was only working 20 hours. At around $10,000 per contract, I was losing out on $20,000 of monthly income.

Oops. My bad. It's not The Onion. It's CNBC.

Friday, February 12, 2021

I’ve Got Reflation Fatigue

I'm continually told that the US economy is reflating. So where is it?

According to research from the Cleveland Fed, the Median CPI provides a better signal of the inflation trend than either the all-items CPI or the CPI excluding food and energy. According to newer research done at the Cleveland Fed, the Median CPI is even better at PCE inflation in the near and longer term than the core PCE.

Source Data:

St. Louis Fed: Median CPI

Thursday, February 11, 2021

When Will Savers Be Rewarded?

Savers will be rewarded when the cows come home.

After vacationing in Japan for a few decades, the cows recently launched into space and were last seen roaming the Alpha Centauri system.

Wednesday, February 10, 2021

Pent-Up Demand

This would probably be a bad time to remind everyone that my significant other cuts my hair now, does a more than adequate job of it, and will continue doing so in the future.

This would also be a bad time to point out that she is currently learning how to groom our Shih Tzu. We recently bought high-end dog clippers and a folding grooming table from Amazon.

This would defintely be a bad time to point out that it once cost 4 times more to groom our Shih Tzu than to groom me.

Tuesday, February 9, 2021

The Future of Retail Employment

In December 2020, there was $132k in nonstore retail sales per nonstore retail employee. That's a whopping $1.6 million per year pace and it’s a pace that continues to grow much faster than inflation.

There really isn't much of a future for retail employment, unless one happens to be a robot.

July 15, 2020

Reuters: Japanese robot to clock in at a convenience store in test of retail automation

TOKYO (Reuters) - In August, a robot vaguely resembling a kangaroo will begin stacking sandwiches, drinks and ready meals on shelves at a Japanese convenience store in a test its maker, Telexistence, hopes will help trigger a wave of retail automation.

Monday, February 8, 2021

Nonstore Retailer Gain

What the Great Recession taketh away, the pandemic (temporarily?) giveth back.

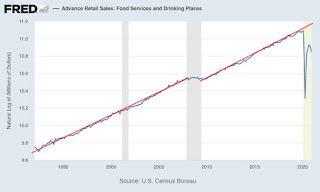

Unprecedented Restaurant Pain

This is probably the most disturbing exponential trend failure that's ever been posted on this blog. The pandemic makes the Great Recession look like a minor hiccup. Will things ever return to normal? How many restaurants will actually survive?

The Fed vs. Long-Term Treasuries

2 predictions for my lifetime:

1. The spread will never reach the yellow line again.

2. The spread will never go below zero again.

I do not believe that our increasingly leveraged economy can tolerate a 4% yield on the 30-year Treasury bond again. If so, the only way to reach the yellow line is if the Fed funds rate actually goes negative while long-term rates are still high. Not going to happen.

The upward slope of the green trend line shows that the Fed is finding it easier and easier to slide us into recessions. I strongly suggest that they acknowledge this trend instead of raising rates until another crash occurs. It just doesn't take as much effort to strangle an increasingly leveraged society.

Note: These are only predictions for my lifetime. If you are much younger than me, sorry about that. If it is any consolation, Rome did not fall in a day. These predictions might hold true for your lifetime as well. I just wouldn't count on it. Once again, sorry about that. Borrowing excessively from the future to pay for today is what we do. Wasn't my plan. Isn't how I prefer to live. Can't go on forever.

Sunday, February 7, 2021

The Ongoing Baby Bust

Brink: The Coming Baby Bust Caused by COVID-19

We’re already down 500,000 to 600,000 births per year from the recent peak in 2007, so now you’re starting to talk about approaching a million fewer babies born per year.

The following chart shows the fertility rate since 2007.

According to the United Nations Population Division, our fertility rate needs to be 2.1 just to maintain our population. Our recent 2007 peak was barely adequate, and it's been downhill ever since.

Over the long-term, those expecting a booming economy and higher real yields on investments will most likely be sorely disappointed. Welcome to Japan. Prepare for endless ZIRP. Brace for continued fertility rate disappointments as more and more come to realize the dire situation we find ourselves in.

For those who thought Trump would make America great again, you might want to look closely at the fertility rate since he was elected in 2016. Chaos and incompetence at the top only led to more uncertainty and divisiveness at the bottom. Chaos, incompetence, uncertainty, and divisiveness are not exactly great underlying conditions for fruitfulness and multiplication, if you catch my meaning.

Thursday, February 4, 2021

Gamestomped

I’d comment on GameStop (GME) again today, but another picture’s worth another thousand words.

And no, it isn't the same picture as the last one, or a mirrored version of it. Wasn't even taken the same month. I kid you not. If you are experiencing serious déjà vu, blame the GameStop traders.

Wednesday, February 3, 2021

Addicted to Rising Debt and Falling Interest Rates

This chart shows the 10-year Treasury bond yield compared to the inverse of our economy’s total debt securities and loans. It is not a coincidence that they are clearly highly correlated. They are our two linked financial addictions. Our debt is growing exponentially as our interest rates decay exponentially. Can’t really have one without the other.

In theory, our debt can approach infinity if and only if interest rates approach zero. This keeps our “what do you want your payments to be” economy in balance for business, home, and auto loans.

In practice, Japan’s debt is approaching infinity as their interest rates remain zero. We’re following their lead.

For two decades, we’ve been listening to the experts talk of normalizing interest rates. My reaction remains the same. Interest rates are normalized. They’ve been normalized for 40 years. As our debt goes up, interest rates must come down. If interest rates don’t eventually come down, the economy collapses.

We all know this. The whole world knows this. Just imagine what a 6%+ yield on the 10-year Treasury bond would currently do to the housing market. Housing would implode. We saw a yield this high in 2000. 2000 is over though. It’s 2021 and our debt is so much higher now. Can’t live in the past.

For those worried about inflation, we’re so addicted to debt that 4% Treasury yields should be more than enough for a major deflationary event, especially with the stock market’s current level of exuberance and so many people parsing every word out of Powell’s mouth for any signs of tightening.

The party can continue as long as debt rises to stimulate this economy and interest rates fall to stimulate this economy. Don’t think of our economy as a patient in the intensive care unit. Think of it instead as an addict with stimulants in both hands. Over the long-term, this can’t end well. It has has worked for 40 years so far though, so good luck betting on the timing. In the meantime, stimulated life goes on.

462 Weeks Later

Click to enlarge.

28 Weeks Later Tagline:

When days turn to weeks, the horror returns.

When weeks turn to months...

When months turn to years...