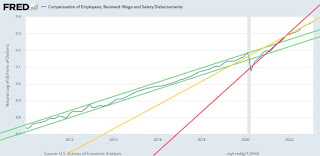

The following chart shows the natural log of U.S. wage and salary disbursements. When using natural logs, constant exponential growth is seen as a straight line.

The Fed does not need to deflate wages back into the long-term channel in green, but rather to return to the slope of that channel. What's done is done. Deflation to undo the high inflation is definitely not the goal.

Some progress is being made. We've noved from the steep slope of the red line to the more moderate slope of the yellow line.

I'm convinced that they can achieve their goal, one way or another. But at what cost? I can be a bit cynical, but there's a high risk here that we're still in the early stages of a no-win situation.

How high will the unemployment rate need to rise to get us back to the healthier wage inflation trend? I have no idea, but I can say with 100% certainty that 100% unemployment would do it. Can't have any wage and salary disbursements if nobody is working.

The bulk of my net worth sits in inflation-protected I-Bonds and TIPS. As of about a year ago, my IRA sits entirely in bonds without inflation protection (TLT). And here's where I sit until I see a reason to take on more risk. Near record unemployment expected to rise, falling house prices, and high interest rates are not things that make me excited about taking on riskier investments.

Not investment advice.

Tuesday: Small Business Index

-

[image: Mortgage Rates] From Matthew Graham at Mortgage News Daily: Mortgage

Rates Continue Higher For Third Straight Day

For the entire 2nd half of June, ...

5 hours ago