Apple added trend analysis to their Health app. The added functionality really helps me understand what's actually going on. No longer must I guess at the direction my weight is heading.

Here's my weight over the past month:

Very disappointing month. I was under the impression that I was losing weight, but when a $2.7 trillion company says there is no discernable trend downward even as I walk 9+ miles per day and count calories, I have no choice but to concede that they must be right. Any optimism I once had has been replaced by a feeling of complete hopelessness. It's the kind of hopelessness that only a few quarts of ice cream could temporarily undo.

Here's my weight over the past 6 months:

Once again, my assumptions are found to be lacking. I was under the misguided impression that I started losing weight at Halloween, as a defiant response to leftover candy and a long-term trend that I finally decided to reverse. That could not be farther from the truth. As seen in the professional trend analysis, my quest actually began just 7 weeks ago. While not the good news that I had hoped, at least there is some hope here. It does shatter my self-confidence to be that far off on the timing though.

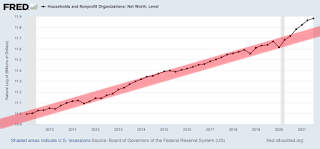

The future is bright. I'm looking forward to the day when this trend analysis technology can be applied to investments, and you should too. Can you imagine all the money we'd make being able to spot new trends in real time? I wouldn't expect Apple to provide professional tools for free though. They will most likely monetize it. But still, there should be so much money rolling into our investment portfolios that we won't care in the slightest. That's a win win for both Apple and us!

Monetize is such an awesome word. What a great day it is to be able to work monetize into a post! Monetize! Monetize! Monetize! All the world is our monetized oyster! Woohoo!

And lastly, there are other obvious uses for this trend analysis technology. For example, full self-driving cars clearly need to understand the movement trends of the objects around them. In real time! Now that weight trend analysis has been mastered, how hard can it be?