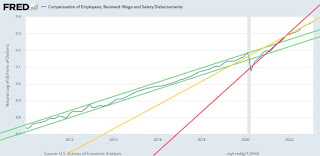

The following chart shows the natural log of U.S. wage and salary disbursements. When using natural logs, constant exponential growth is seen as a straight line.

The Fed does not need to deflate wages back into the long-term channel in green, but rather to return to the slope of that channel. What's done is done. Deflation to undo the high inflation is definitely not the goal.

Some progress is being made. We've noved from the steep slope of the red line to the more moderate slope of the yellow line.

I'm convinced that they can achieve their goal, one way or another. But at what cost? I can be a bit cynical, but there's a high risk here that we're still in the early stages of a no-win situation.

How high will the unemployment rate need to rise to get us back to the healthier wage inflation trend? I have no idea, but I can say with 100% certainty that 100% unemployment would do it. Can't have any wage and salary disbursements if nobody is working.

The bulk of my net worth sits in inflation-protected I-Bonds and TIPS. As of about a year ago, my IRA sits entirely in bonds without inflation protection (TLT). And here's where I sit until I see a reason to take on more risk. Near record unemployment expected to rise, falling house prices, and high interest rates are not things that make me excited about taking on riskier investments.

Not investment advice.

This is the End and a New Beginning

-

I've been thinking about this for some time.

After 21 years of writing this blog almost daily, I've decided to stop

writing the daily updates on the blog.

...

4 weeks ago

18 comments:

In good times I’m told, “Don’t fight the Fed.”

Shouldn’t that apply in bad times too?

Your logic is sound. (Sits in silence)

A thought. Just push up the green line so that the blue line fits. Never Better!

You’re right. Could probably fill that green channel with some expanding foam. That might fix it.

Or alternatively, I find that the chart looks less scary when you step back a few hundred yards. Looks like any other chart at that range. Well, assuming you don’t have a chart telescope, of course. ;)

The Fed will do its bit to flatten the Fight for 15.

Red line is already broken, just need to get from yellow to green. I think you do that by mixing in the blues. As long as more employees get the blues, it will blend with the yellow and we'll be back to green in no time. Right as rain!

I know you’ve put a lot of thought into TLT, TIPs and I savings bonds so I’d like to take advantage of your knowledge in this area.

If I understand the vehicles correctly, TIPs and I Savings bonds would do about the same over time given the same inflation rate, but that TIPS don’t have the disadvantages of the maximum annual contribution limit or the early withdrawal interest penalty (if you needed to sell within 5 years).

Relative to TLT and TIPs, it would seem that TLT might be the better selection for a trade if interest rates were expected to fall in the next year or so, but that TIPs would be better if inflation was expected to stay the same or rise again longer term (after a fall in the short term)?

And last question. Your thoughts about buying actual TIPs via treasury or just buying the TIPS ETF?

Thanks!

Great Unknown,

Feeling especially lazy today. This deserves a long reply and maybe even its own post. Will provide details, answers, thoughts, pros, cons, and opinions by end of (my) day tomorrow. :)

Yeah. I totally understand. Just put it on the “To Do” list.

Thanks!

Long-Term government bonds bought now:

0.9% I-Bonds: Must hold at least one year. Tax-deferred until cashed out. Limited amount can be purchased each year. If sold within 5 years, lose last 3 months interest. Will always be worth at least as much as they were the previous month, even if interest rates rise. You CAN’T lose money. Safest investment of all the choices. On the other hand, if interest rates fall, you will not make extra money, for there is no way to resell them to others. Therefore, best to purchase if you are worried about interest rates continuing to rise.

1.6% TIPS: Pays more interest than I-Bonds. Not tax-deferred. If sold before maturity, will need to pay transaction fees. Bond transaction fees are higher than when trading stocks and often not nearly as transparent. No transaction fees or expenses if bought directly from government and held to maturity. If interest rates rise, resell value goes down. You can lose money. If rates fall, resale value goes up. Best to purchase if you believe interest rates will be flat or fall, or you intend to hold to maturity.

3.9% Treasury Bond: NO inflation protection, which can either be good or bad depending on what inflation does. If sold before maturity, will need to pay transaction fees. Bond transaction fees are higher than when trading stocks and often not nearly as transparent. No transaction fees or expenses if bought directly from government and held to maturity. Like TIPS, will lose money if interest rates rise (and you resell them). Best to purchase if you think deflation and/or ZIRP will reappear.

LTPZ: If 1.6% TIPS interest you, then so should LTPZ. Fund expenses are low. Transaction fees are low. Best to purchase if you are betting on TIPS in the short to medium term. If the long-term bonds are intended to be held to maturity, better to buy the individual bonds directly from the government to avoid fund expenses.

TLT: If 3.9% Treasury Bonds interest you, then so should TLT. Fund expenses are low. Transaction fees are low. Best to purchase if you are betting on 3.9% Treasury Bonds in the short to medium term. If the long-term bonds are intended to be held to maturity, better to buy the individual bonds directly from the government to avoid fund expenses.

High inflation over the short-term does not necessarily mean that LTPZ will outperform TLT, by the way. These are long-term investments. It’s not about what inflation is, but more about what it will be. Both TLT and LTPZ are taking damage from the short-term inflation problem, as the Fed has been forced to fight it. And even with inflation running hot, TLT has been doing at least as well as LTPZ. Rising interest rates have been the bigger story, and rising real rates in particular.

I am not losing sleep over owning TLT, nor am I losing sleep over my individual TIPS. I think we’re very close to a peak in long-term interest rates, both real (inflation adjusted):and nominal. Might be ignorance is bliss though, if I am wrong not to be losing sleep. Regardless, I am pleased that I own so many I-Bonds though. They have definitely not been losing money. They’ve been a great investment since 2000, and have really been shining lately.

In summary, I think there are good reasons to own all the bonds I’ve mentioned here. These are the best interest rates long-term savers have seen in quite a few years. Of the choices, I don’t really have much of a preference (other than my usual TIPS and I-Bond bias). I would much rather own any of them than short-term bonds with instant gratification, that may not last long if ZIRP returns. I’m all about locking in good deals, and 1.6% over inflation is a pretty good deal over the long-term given what I think is coming (again).

I’d love to be optimistic and change my blog’s name to simply Prosperity, but I just can’t believe that a pandemic can improve our country’s long-term prosperity. Seems much more likely to be a version of the deluded broken window fallacy, where bad things do eventually lead to bad things.

I had one more unimportant sentence to add, but I reached the limit on how many characters could be posted in a reply. That’s a first. It’s therefore a personal best for how long-winded I could be in the comments of my blog, lol. :)

Bonus sentence:

I’m definitely not a believer that the more we break, the more prosperous we will be. *shrug*

Thanks for this. Strategy is good.

Wow! That info is pure gold and a very comprehensive explanation. As you mentioned it’s worthy of a blog post.

Thanks so much!

I bought TLT and EDV too early last year, but fortunately I had enough cash in reserve to dollar cost average on the way down. Then when they rallied back up, I luckily exited my positions near the short-term top for a small percentage loss. I started building the positions back as the prices dropped again. So my new cost basis is a lot better now.

Thanks for the mention of LPTZ. It looks like a better ETF than TIPS.

I have some very short term T-Bills coming due over the next three months and I plan to go with longer term treasuries.

Like you I was lucky to buy I savings bonds back in 2000, 2001 and 2002. We’ve been getting some very good interest on those over the past year! Of course, it’ll be painful paying the tax man when they mature, but it beats having losses!

Great Unknown,

May 30, 2023

CNBC: What to do with an extra $100

An extra $100 is the perfect amount to dip your toe into the stock market.

Perfect amount!! Everyone should easily have an extra $100 after all the excellent ideas CNBC has given us this month. It’s only 36 minutes of actual work!

May 28, 2023

CNBC: 34-year-old makes up to $167 an hour nannying for the mega-rich: I could work just 2 months a year and ‘be fine’

Prosperity click bait. *shrug*

There’s never a bad tine to buy according to CNBC. They won’t be happy until the last retail investor is “all in.”

Sigh.

It’s an especially bad time to buy right now, at least for me.

A fraudulent charge appeared on my credit card this morning, so I called my credit card company and they are sending me a new card. It’s my only credit card, so no online buying for me until it gets here.

I’ve had the card 30 years. If memory serves, this is the third time it has happened. The last time was just in the past year or two. It’s anecdotal to be sure, but the fraud appears to be accelerating.

Illusion of Prosperity?

The Age of Fraud?

Ugh.

That sounds like a forced savings plan. That scammer did you a favor!

The “have not” economy does seem to be headed our way.

As you say, labor market is tight and savers have it pretty good right now.

That was also true in 2000 and 2007 though. As a long-term saver, I do have an uneasy feeling that the pendulum may soon swing the other way.

Doesn’t change your “have not” theory though. I’m a believer in that.

My strategy for the year has been to hold VTIP in both personal and retirement accounts, and channel the dividends to my treasury money market accounts. VTIP, of course, distrbutes its securitys' inflation adjustments to principal as a dividend, together with interest from those securites - an ideal inflation adjusted income stream, though I'm saving it all since I have sufficent income from pension and social security. VTIP has been maligned by some for transient share price "loss" from rising rates, but that's a misplaced view which conflates bonds with "total return" notions more pertinet to stocks.

Post a Comment